I will be hosting the Life Insurance Special Interest Group (SIG) at the upcoming Novarica Research Council Meeting. In preparation, I have been reaching out to Council members to discuss the key opportunities and challenges facing their companies. There are three dominant themes of these discussions: user experience, underwriting automation, and ubiquitous security.

I recently had the opportunity to attend MRC Vegas 2018 for the first time in many years. When I attended Merchant Risk Council meetings in the past, I was a fraud executive with one of the largest U.S. banks. I had found MRC to be a good event for networking and gaining a better understanding of the fraud-related concerns of the bank’s commercial clients.

This was my first experience attending MRC as an industry research analyst. I cover fraud and data security issues for Aite Group; most of my coverage is from a banking perspective, but I wanted to learn more about the challenges merchants are facing in today’s environment. I also wanted to understand how merchants’ fraud and risk challenges compare with those experienced by financial institutions.

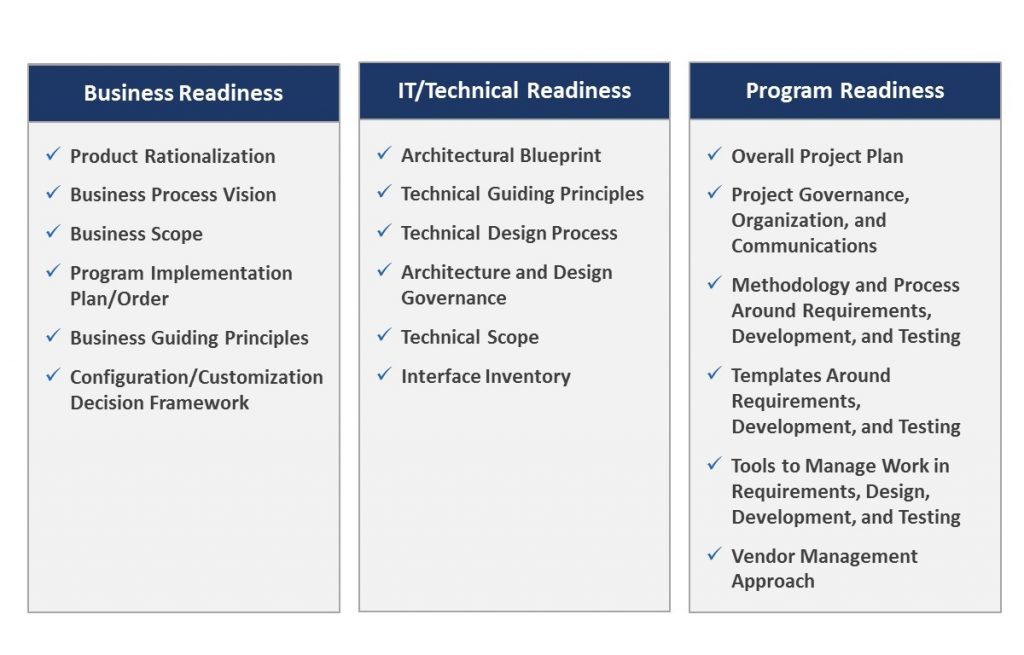

Insurance core systems transformation projects are large, complex efforts that require not only significant financial investment, but also significant organizational commitment. To be successful, these projects necessitate careful planning and an enterprise-wide understanding of the changes to come. Neglecting to appropriately plan up front can result in such problems as disagreement, analysis paralysis, and a general project “swirl,” which can lead to cost overruns and project delays.

Insurance core systems transformation projects are large, complex efforts that require not only significant financial investment, but also significant organizational commitment. To be successful, these projects necessitate careful planning and an enterprise-wide understanding of the changes to come. Neglecting to appropriately plan up front can result in such problems as disagreement, analysis paralysis, and a general project “swirl,” which can lead to cost overruns and project delays.

Life and annuity insurers are strongly interested in new policy administration systems (PAS), with PAS replacements remaining a top priority. The primary business drivers for life and annuity carriers are the ability to launch new products quickly and to effectively leverage digital channels and advanced analytics. Additionally, carriers are also concerned about the long-term costs and sustainability of their legacy systems.

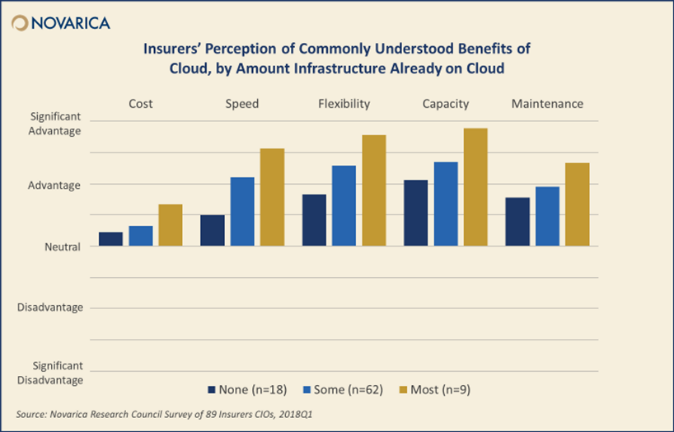

The number of insurers using cloud computing has tripled in the last few years, from less than 20% to more than 70%, according to our new research from a study of 89 insurer CIOs. As cloud computing has gone mainstream, most insurers are incorporating cloud into their technology architectures, and they are seeing significant benefits in speed, flexibility, and capacity from using cloud over traditional architectures.

The number of insurers using cloud computing has tripled in the last few years, from less than 20% to more than 70%, according to our new research from a study of 89 insurer CIOs. As cloud computing has gone mainstream, most insurers are incorporating cloud into their technology architectures, and they are seeing significant benefits in speed, flexibility, and capacity from using cloud over traditional architectures.

Pages

- « first

- ‹ previous

- 1

- 2

- 3

- 4

Authors

Archive

- 2023-06 (16)

- 2023-05 (18)

- 2023-04 (18)

- 2023-03 (24)

- 2023-02 (21)

- 2023-01 (22)

- 2022-12 (12)

- 2022-11 (18)

- 2022-10 (13)

- 2022-09 (23)

- 2022-08 (24)

- 2022-07 (24)

- 2022-06 (16)

- 2022-05 (17)

- 2022-04 (19)

- 2022-03 (15)

- 2022-02 (20)

- 2022-01 (14)

- 2021-12 (10)

- 2021-11 (18)

- 2021-10 (11)

- 2021-09 (14)

- 2021-08 (12)

- 2021-07 (15)

- 2021-06 (20)

- 2021-05 (22)

- 2021-04 (22)

- 2021-03 (26)

- 2021-02 (26)

- 2021-01 (19)

- 2020-12 (17)

- 2020-11 (22)

- 2020-10 (24)

- 2020-09 (29)

- 2020-08 (40)

- 2020-07 (31)

- 2020-06 (29)

- 2020-05 (32)

- 2020-04 (42)

- 2020-03 (32)

- 2020-02 (18)

- 2020-01 (12)

- 2019-12 (7)

- 2019-11 (19)

- 2019-10 (29)

- 2019-09 (11)

- 2019-08 (22)

- 2019-07 (7)

- 2019-06 (9)

- 2019-05 (28)

- 2019-04 (22)

- 2019-03 (21)

- 2019-02 (20)

- 2019-01 (12)

- 2018-12 (6)

- 2018-11 (15)

- 2018-10 (25)

- 2018-09 (21)

- 2018-08 (20)

- 2018-07 (13)

- 2018-06 (17)

- 2018-05 (27)

- 2018-04 (20)

- 2018-03 (36)

- 2018-02 (19)

- 2018-01 (24)

- 2017-12 (1)

- 2017-09 (2)

- 2017-08 (1)

- 2017-06 (1)

- 2017-05 (2)

- 2017-04 (1)

- 2017-03 (3)

- 2017-02 (5)

- 2017-01 (1)

- 2016-12 (1)

- 2016-11 (3)

- 2016-10 (4)

- 2016-09 (2)

- 2016-08 (2)

- 2016-07 (4)

- 2016-06 (7)

- 2016-05 (4)

- 2016-04 (3)

- 2016-03 (4)

- 2016-02 (5)

- 2016-01 (8)

- 2015-12 (5)

- 2015-11 (1)

- 2015-10 (1)

- 2001-07 (1)