Insurance core systems transformation projects are large, complex efforts that require not only significant financial investment, but also significant organizational commitment. To be successful, these projects necessitate careful planning and an enterprise-wide understanding of the changes to come. Neglecting to appropriately plan up front can result in such problems as disagreement, analysis paralysis, and a general project “swirl,” which can lead to cost overruns and project delays.

Insurance core systems transformation projects are large, complex efforts that require not only significant financial investment, but also significant organizational commitment. To be successful, these projects necessitate careful planning and an enterprise-wide understanding of the changes to come. Neglecting to appropriately plan up front can result in such problems as disagreement, analysis paralysis, and a general project “swirl,” which can lead to cost overruns and project delays.

Even though these projects pose many challenges, for most insurers, they are necessary. The benefits are clear, including: improved time to market, increased business and IT agility, greater flexibility, reduced technical risk, and more, which ultimately lead to improved employee, agent, and customer satisfaction.

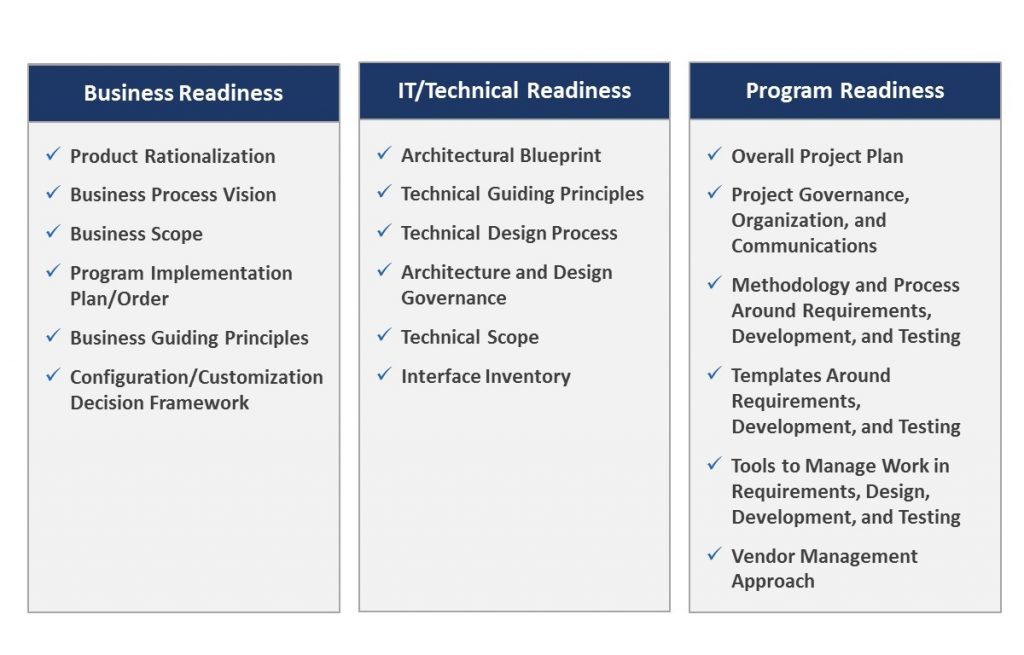

To realize these benefits of modern solutions and to ensure successful implementation, carriers need to take a number of steps during the planning phase, covering business readiness, IT/technical readiness, and program readiness. It is important to lay out the business vision and ensure that the stakeholder business units are prepared for the project. IT and technical readiness is about translating the business vision into a strategic technology vision, and then the program readiness piece is about making sure carriers recognize that they own the transformation project, not the vendors and system integrators.

Ultimately, insurers are responsible for the success of their core systems transformation projects. While it is impossible to foresee every difficulty that may be encountered over the course of a project, collaborating with partners before the project begins to have a clear idea of the project’s business vision and scope, technical approach, development processes, and tools can significantly reduce the risk.

For more on this, see my recent brief, Core Systems Project Readiness, in which we’ve put together a three-part framework of key assets and steps for the pre-project planning process, including a checklist of inventory items and preparatory activities for insurers to consider.

Add new comment