External Data in Insurance: Overview and Prominent Providers

Report Summary

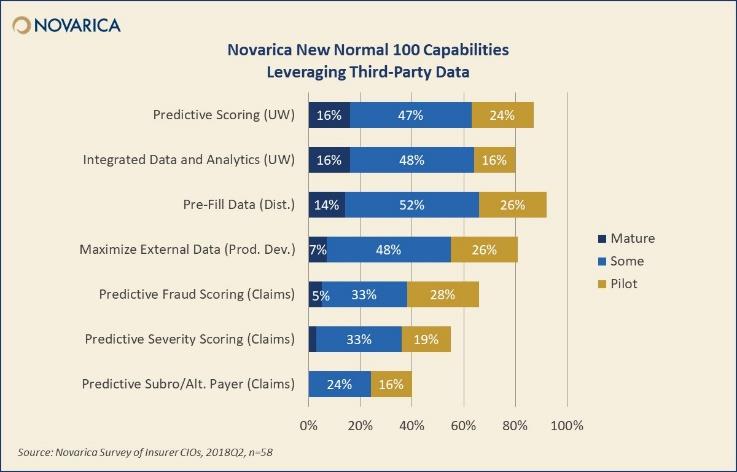

November 2018 - Insurers are increasingly interested in leveraging third-party data for analytics augmentation, for predictive modeling, and for the validation/cleansing of existing data.

November 2018 - Insurers are increasingly interested in leveraging third-party data for analytics augmentation, for predictive modeling, and for the validation/cleansing of existing data.

This report reviews multiple insurance industry use cases for third-party data and examples of insurers that are investing in this area. It also includes profiles of 30 data providers used by insurers.

Key Points and Findings

- Drivers of third-party data usage include AI, customer experience, cost, and regulation. The need for large datasets to train AI and customer buying experience expectations as set by online retailers stand out as relatively new motivators.

- Privacy concerns have made transparency in use of data critical. Scandals such as Cambridge Analytica, along with the GDPR and similar regulations, have increased the demand for transparency in what data is used for which purposes.

- As core systems providers increasingly incorporate AI and analytical capabilities, the hunger for data will only increase. The good news is, this will lead to greater efficiency and improved consumer experience.