April 2021 – Insurers that understand which digital capabilities are required to meet their objectives are better prepared to understand the advantages and disadvantages within the field of solutions marketed as digital platforms.

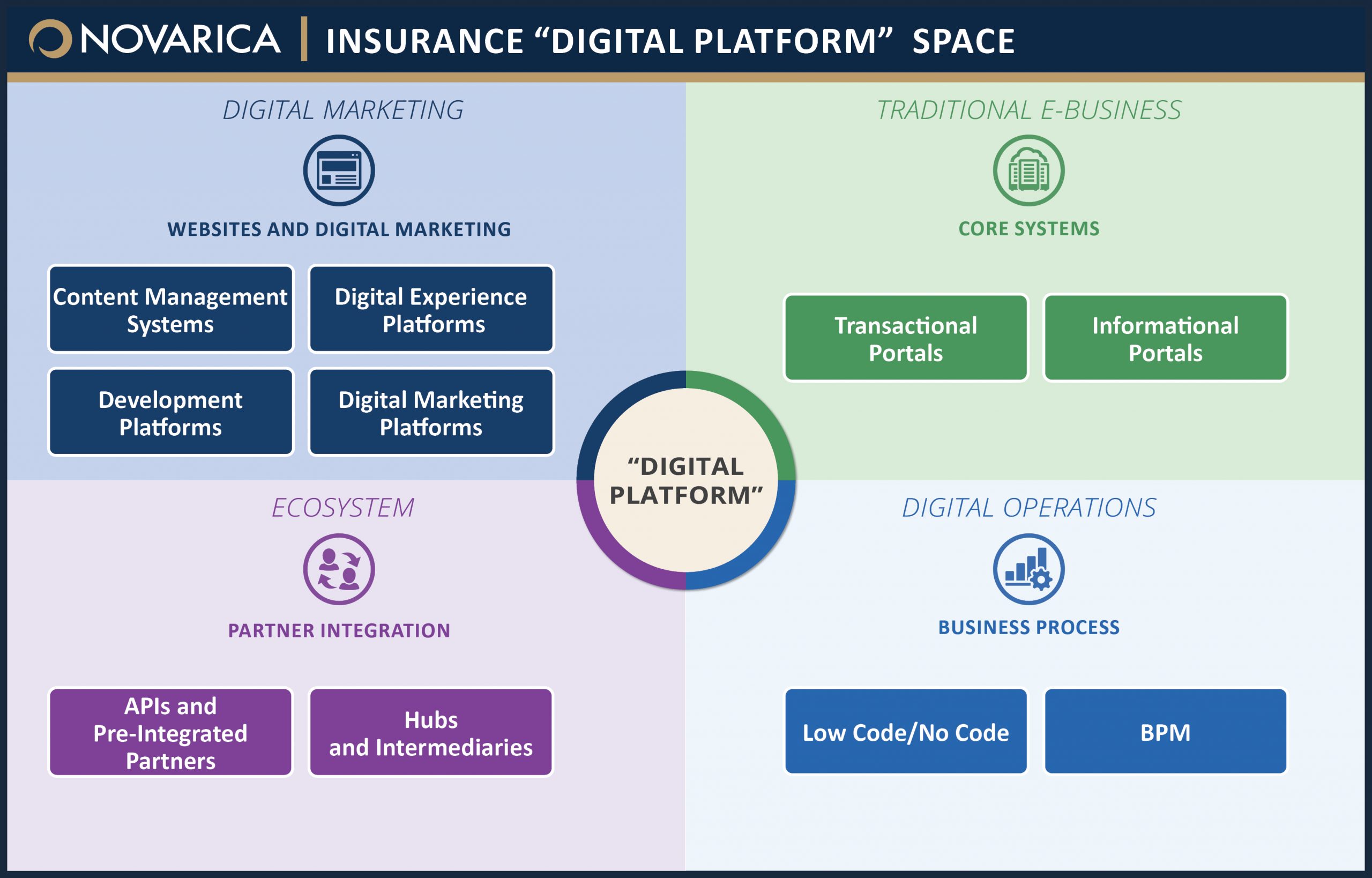

The term “digital platform” in insurance is ambiguous. A wide range of solution types are marketed to insurers as “digital platforms,” from digital experience and digital marketing platforms to pre-built portals and low-code/no-code, and even hubs and intermediaries.

This report is designed to help insurers understand the differences within this space and align their needs to the right class of solution. It includes more than 20 named examples of insurer digital initiatives and the specific solutions that they used, drawn primarily from Novarica case studies.

Key Points and Findings

- The “digital platform” marketplace is so diverse that it’s hard to navigate. Vendor marketing is confusing, with widely different solutions marketed with the same terms.

- Providers come from different perspectives and solve different problems. Marketing/website, pre-built portals, business process tools, and partner integration all address different needs.

- Custom development is common. Many insurers choose to build, leveraging development platforms or low-code/no-code tools to create digital experiences.

About the Author

Datos Insights

We are the advisor of choice to the banking, insurance, securities, and retail technology industries–both the financial institutions and the technology providers who serve them. The Datos Insights mission is to help our clients make better technology decisions so they can protect and grow their customers’ assets.