Small-Business RDC: Strategies for Success

Report Summary

Small-Business RDC: Strategies for Success

Despite high RDC adoption by banks, end-user adoption, especially among small-business customers, remains extremely low.

Boston, November 3, 2011 – A new report from Aite Group sizes the opportunity for small-business remote deposit capture (RDC) in the United States. Based primarily on an August 2011 Aite Group survey of 291 U.S. small businesses and a September 2011 Aite Group survey of 20 of the 100 largest banks, the report analyzes the key challenges institutions face when selling this product and highlights effective strategies for increasing success. It is the first in a series of small-business reports designed to help financial institutions and their technology partners better serve this often-challenging customer segment.

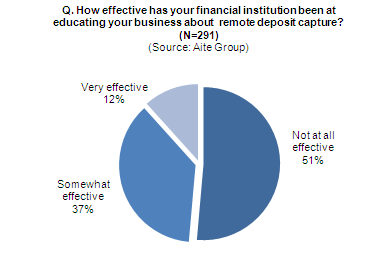

RDC, the ability for business customers to scan a check and send the check image electronically to their financial institution for deposit, is not a new technology. More than 50% of U.S. banks have already deployed the technology, and others plan to do so in coming months. Despite high RDC adoption by banks, end-user adoption, especially among small-business customers, remains extremely low. As banks increase their focus on the small-business customer segment, it is critical that they not only offer RDC, but also that they implement effective RDC marketing and customer-education initiatives, provide an efficient customer onboarding process, match product benefits with customer pain points, and create well-thought-out pricing models and product bundles.

“Small-business RDC adoption rates are falling below expectations at more than 60% of large U.S. banks,” says Christine Barry, research director with Aite Group and co-author of this report. “Small businesses need RDC, and banks can charge for it. But money is being left on the table due to low adoption levels and less-than-proactive strategies.”

This 28-page Impact Report contains 28 figures. Clients of Aite Group’s Wholesale Banking service can download the report.