Community Banks: Maximizing the Small-Business Opportunity

Report Summary

Community Banks: Maximizing the Small-Business Opportunity

Community banks find it difficult to capitalize on small-business customers, but the benefits justify the costs of a well-executed strategy.

Boston, September 13, 2011 – A new report from Aite Group analyzes the small-business banking strategies of U.S. community banks. Based primarily on a May to July 2011 Aite Group survey of 100 U.S. community banks (less than US$5 billion in assets), the report analyzes community banks’ current use of the online banking channel, vendor preferences, and planned enhancements to online business banking functionalities. It also highlights these banks’ growing interest in using the mobile channel, remote deposit capture (RDC), and social networking to better connect with small businesses.

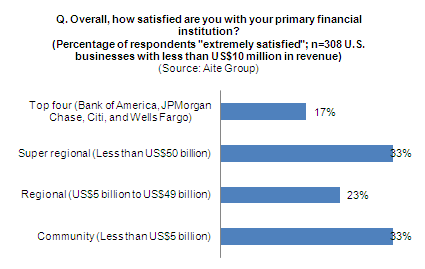

The small-business customer segment represents an opportunity for community banks to grow much-needed deposits and fee-based revenue, but capitalizing on this opportunity is no easy task. While U.S. small businesses spend more than US$400 billion on financial products each year, understanding their needs continues to challenge many financial institutions—this shows in small-business customers’ satisfaction levels. Community banks hoping to increase their penetration into the small-business banking segment must allocate sufficient resources to train staff about small-business customer needs, broaden their small-business product portfolios, and leverage the necessary technology to increase small-business convenience and access to information.

“Small businesses remain underserved by their financial institutions, and their satisfaction levels are lower than they should be,” says Christine Barry, research director with Aite Group and author of this report. “Community banks able to successfully serve this segment will find that the benefits far outweigh the costs. By offering the right banking channels and leveraging technology partners, community banks will see increased satisfaction among existing small-business customers and increased opportunities within the segment.”

This 28-page Impact Note contains 26 figures. Clients of Aite Group's Wholesale Banking service can download the report.