Commercial Loan Processing Solutions and Analytics: U.S. Community Banks Weigh In

Report Summary

Commercial Loan Processing Solutions and Analytics: U.S. Community Banks Weigh In

For community banks, improving small-business customers’ loan-application experience has become a key focus.

Boston, November 17, 2011 – A new report from Aite Group analyzes commercial-loan-technology challenges at U.S. community banks. The report is based primarily on a May to July 2011 Aite Group survey of 100 U.S. community banks that have less than US$5 billion in assets.

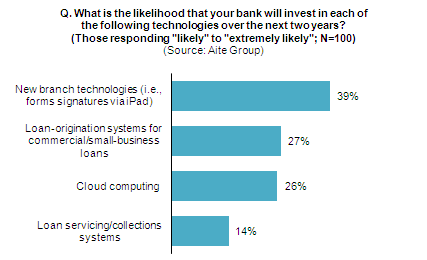

Community banks rely on the small-business loan customer to anchor the bank’s business-banking platform. Traditionally, these customers have rewarded the institution that grants them loans by adding other revenue-generating products, but demand for loans started to plummet in 2008. To improve financial performance, many community banks reviewed the commercial-loan-application process for additional efficiency gains, and found that most functionality improvements to date have concentrated on the loan servicing/collection process. Going forward, opportunities for community banks lie less in process improvement and more in growing small-business loan portfolios. Attracting and acquiring business customers who want to borrow is critical, and improving the small-business customers’ loan-application experience has become a key focus.

“Lending to small businesses provides considerable payback in terms of customer loyalty and increased revenue from all manner of fee-based services,” says Christine Pratt, senior analyst with Aite Group and co-author of this report. “Failing to provide services to small businesses will result in painful losses for community banks. There are three areas in which small businesses expect community banks to step up their game: loan products, loan-application processes, and loan servicing. Many community banks have recognized the technological challenges and opportunities in these areas, and are committed to investing for successful growth.”

Solutions from the following technology vendors are referenced in this report: AFS, CGI Group, CRIF, FICO, Fiserv, Harland Financial Solutions, HCL Technologies (Capital Stream), Open Solutions, and Web Equity.

This 21-page Impact Note contains nine figures and two tables. Clients of Aite Group’s Wholesale Banking service can download the report.