The Changing Dynamics of Merchant Acquiring

Report Summary

The Changing Dynamics of Merchant Acquiring

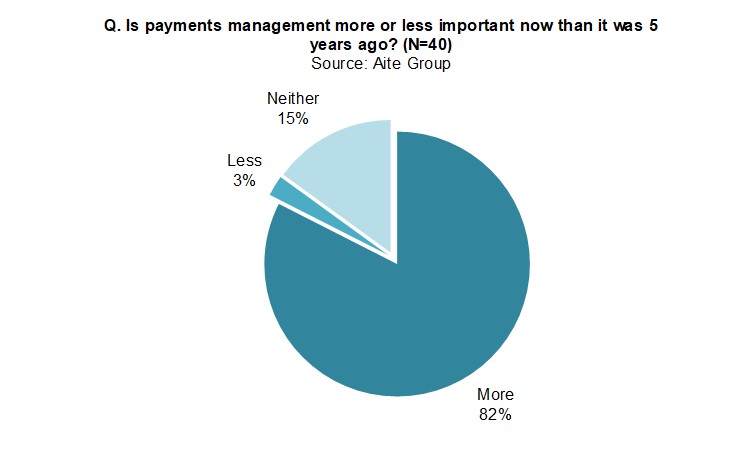

Payment management is more strategically important for merchants than it was five years ago.

Boston, July 18, 2018 – The payments space is simultaneously a massive inertial engine of commerce and a space encountering significant disruption. But there’s no two ways about the fact that payments are increasingly important in the overall commerce and sales equation, and companies that see payments as a strategic asset rather than a necessary utility tend to be more successful than their peers that do not.

This report is based on Aite Group interviews of 40 midsize to large merchants from various industry verticals, conducted in September and November 2017, as well as mid-2017 Aite Group interviews of over 25 executives and thought leaders in the payment ecosystem and the acquiring/processing community.

This 29-page Impact Report contains 16 figures. Clients of Aite Group’s Retail Banking & Payments service can download this report, the corresponding charts, and the Executive Impact Deck.

This report mentions Adyen, Alipay, Bank of America Merchant Services, Cayan, Chase Merchant Services, Citi Merchant Services, Elavon, First Data Merchant Services, Global Payments, iZettle, PayPal, PNC Merchant Services, Qiwi, Square, Stripe, TSYS, Union Pay, Vantiv, WebMoney, WeChat Pay, Wells Fargo Merchant Services, Worldline, Worldpay, and Yandex.