Buy-Side OMS AIM: Change Is Inevitable

Report Summary

Buy-Side OMS AIM: Change Is Inevitable

OMS vendors are breathing new life into solutions with automation and workflow improvements.

Boston, August 9, 2018 – The last two years have been ripe with change in the order management system space. Regulatory developments in both the U.S. and Europe kept the entire industry on edge, electronic trading paradigms have finally bled over to fixed income and derivatives markets, and the industry has seen continued consolidation. Cost pressures and advances in technology have pushed firms to innovate in areas such as automation, artificial intelligence, and cloud deployment. Consequently, the OMSs that support these firms are trying to keep up.

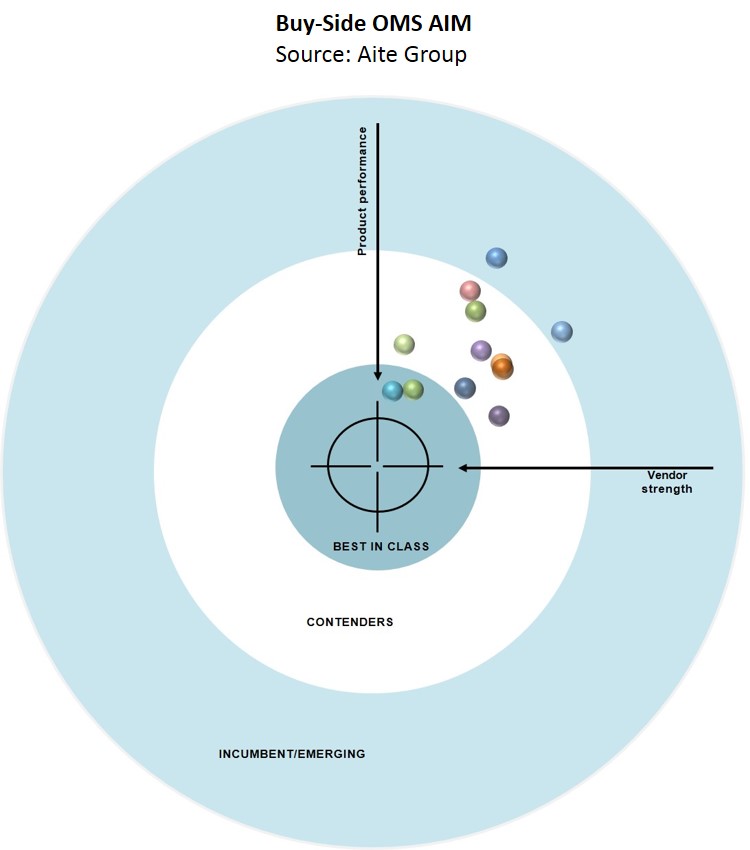

Leveraging the Aite Impact Matrix (AIM), a proprietary Aite Group vendor assessment framework, this report explores some of the key trends within the buy-side OMS market. This research evaluates the overall competitive position of each vendor and recognizes specific vendors for their strengths in critical areas. The AIM framework in this report assesses Black Mountain Systems, Bloomberg, Broadridge, Charles River Development, Enfusion, Eze Software, FIS (Front Arena), IHS Markit, Indata, Linedata, SimCorp, and SS&C Advent. This report also profiles BlackRock, Fidessa, FIS (Asset Arena 360), and ITG.

This 117-page Impact Report contains 61 figures and 12 tables. Clients of Aite Group’s Institutional Securities & Investments service can download this report, the corresponding charts, and the Executive Impact Deck.

This report mentions BATS, Blackstone, CBOE, Citi, Dash Financial, FlexTrade, Goldman Sachs, ICE, Instinet, Ion Trading, Itiviti, JPMorgan, Nasdaq OMX, NYSE, State Street, Temenos, Thomson Reuters, TradeWeb, and Virtu Financial.