Accounts Receivable: Untangling Cross-Channel Complexity

Report Summary

Accounts Receivable: Untangling Cross-Channel Complexity

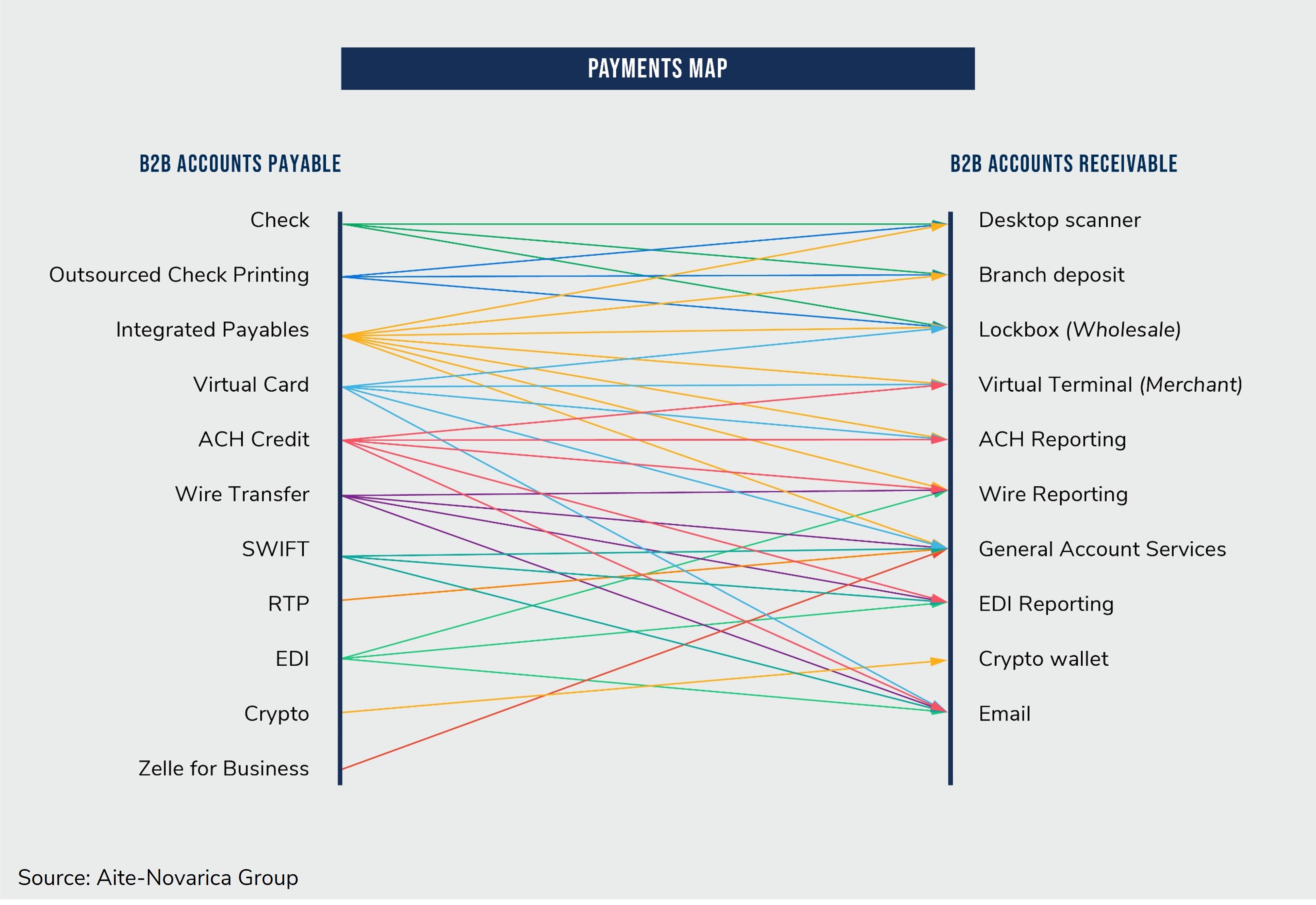

June 15, 2022 – Banks touting the speed of payments and deposits may do so at the peril of AR’s weightier concern: addenda. AR teams experience reduced efficiency when bank reports provide low-quality payment addenda across heterogeneous receivables channels. This dynamic forces AR to manually process each receivable channel separately. Integrating receivables channels and their associated addenda translates to a uniform file ecosystem for AR.

This report reveals the various approaches undertaken by AR to process receivables from various payments channels. The key considerations offered are a starting point for banks to be aware of when evaluating the likelihood of AR adopting a new solution or technology. Based on the author's in-depth knowledge, this report offers a list of key considerations to gauge how likely AR might perceive any new solution or technology as helpful.

This 39-page Impact Report contains 18 figures. Clients of Aite-Novarica Group’s Commercial Banking & Payments service can download this report and the corresponding charts.

This report mentions Apple Pay, Google Pay, PayPal, Samsung Pay, Venmo, and Zelle for Business.