Global Consumers’ Authentication Preferences: Between Fraud and Friction in Digital Banking

Report Summary

Global Consumers’ Authentication Preferences: Between Fraud and Friction in Digital Banking

Consumers have clear preferences on which authentication methods they utilize for their digital banking.

March 29, 2023 – The digital world offers myriad opportunities, but it also presents new and ever-evolving challenges. Fraud attacks are on the rise, and jurisdictions across the globe are enacting new regulatory requirements on fraud detection and authentication mechanisms. FIs must adapt quickly to these changing risks while providing a seamless customer experience, otherwise risk losing customers to other institutions should they not meet consumer expectations on friction.

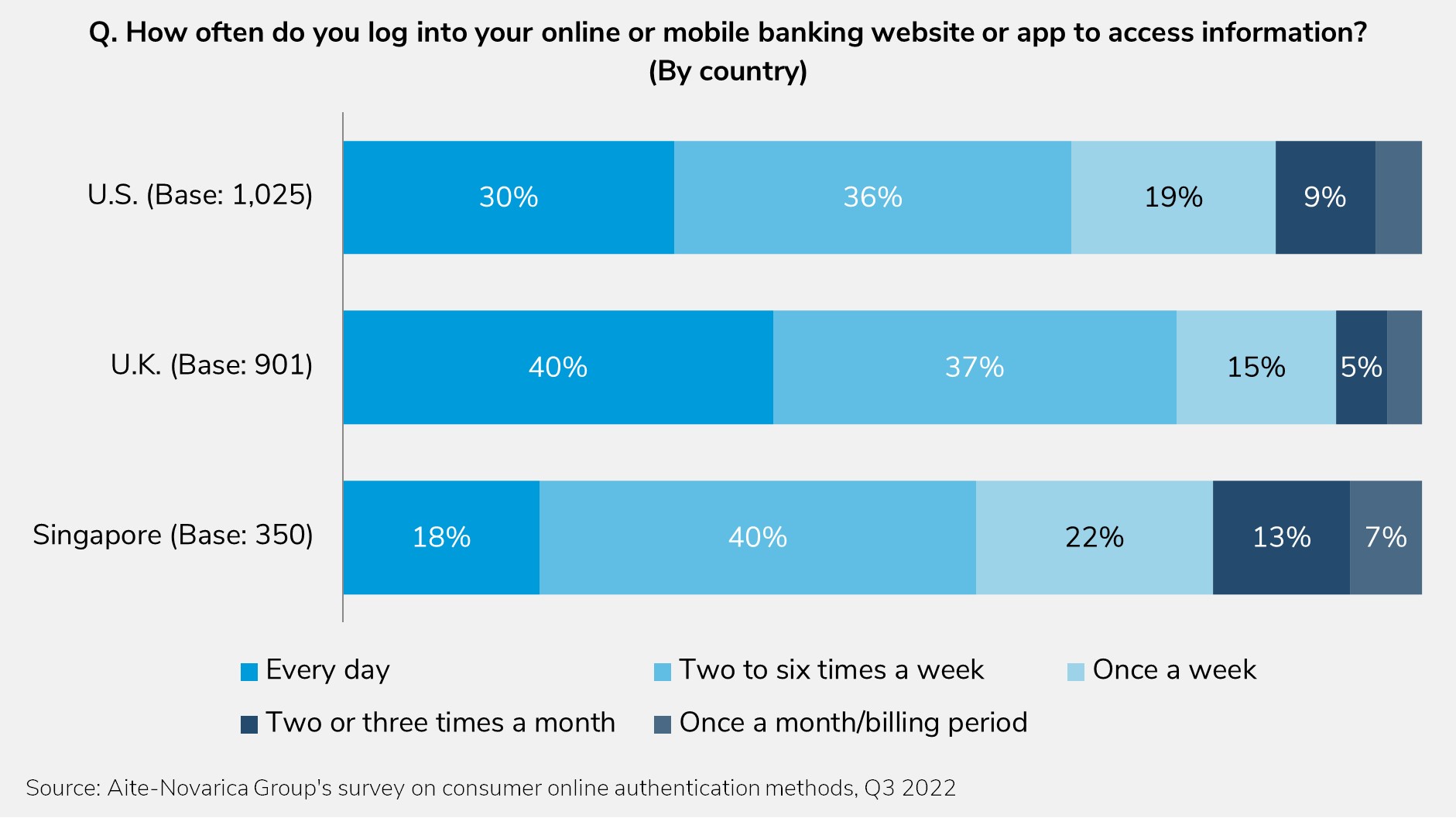

This Impact Report provides insights into consumers’ views on authentication methods based on longitudinal surveys Aite-Novarica Group conducted in 2018 and 2022. It is primarily based on an Aite-Novarica Group survey of 2,276 consumers in the U.K., the U.S., and Singapore in Q3 2022.

Clients of Aite-Novarica Group’s Fraud & AML service can download this report.