Global Consumers’ Authentication Preferences: Education and Incentives in Fighting Fraud

Report Summary

Global Consumers’ Authentication Preferences: Education and Incentives in Fighting Fraud

Growing digitalization has brought unprecedented risks and challenges alongside its opportunities.

March 23, 2023 – Online banking has simplified payments and boosted financial inclusion, but it has also opened new attack vectors and facilitated a global surge in financial crime. Fraudsters have become increasingly clever, and emerging technologies have made attacks more devastating. As financial institutions refine their approaches to authentication, they must also contend with strong consumer authentication preferences and expectations for customer service.

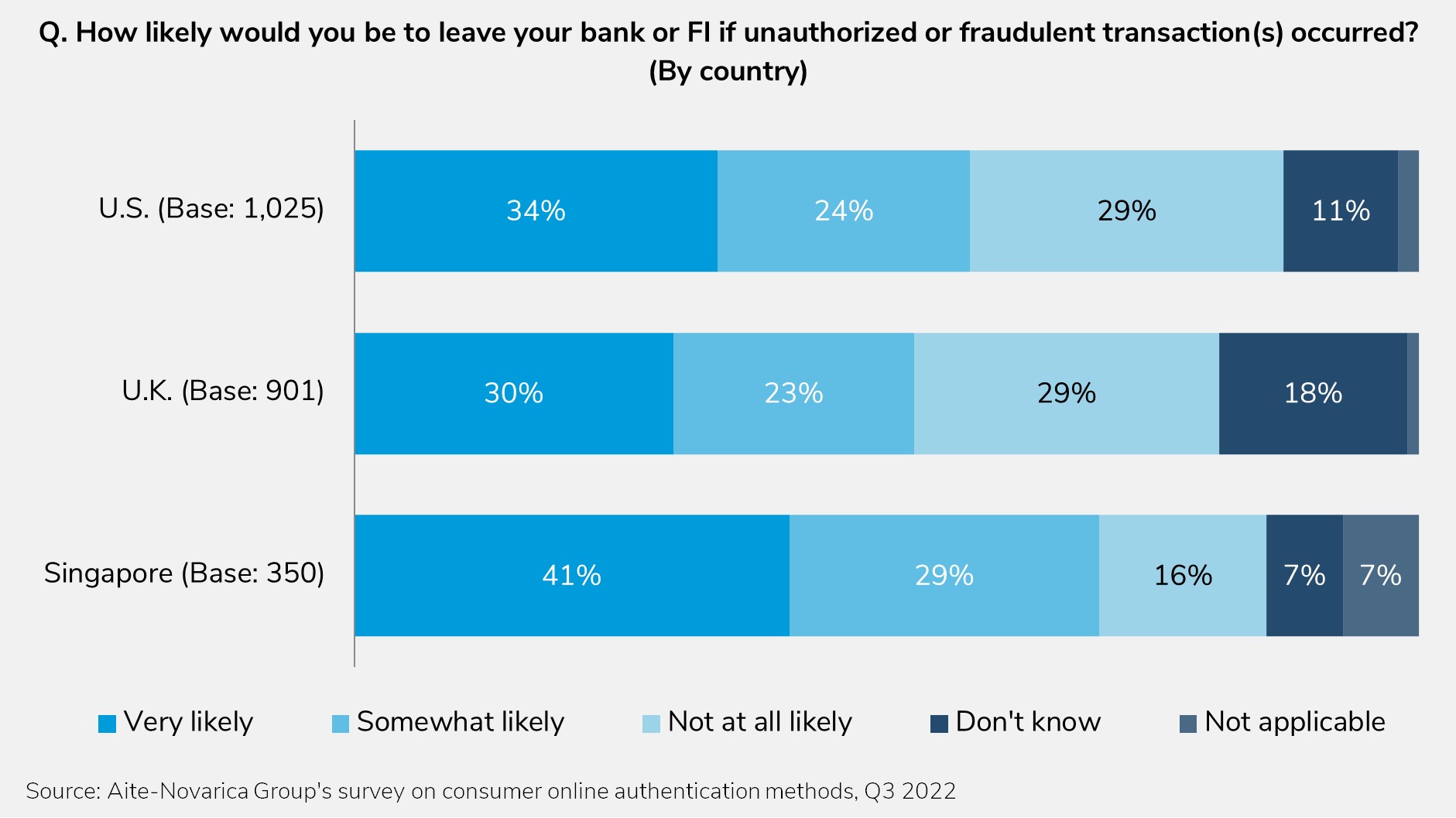

This Impact Brief explores the interplay between the rise in digital banking and fraud, consumer reactions to frustrating incidents, and FIs’ efforts to engage consumers in bolstering authentication. It is based on a Q3 2022 Aite-Novarica Group survey of 2,276 consumers in the U.K., the U.S., and Singapore.

Clients of Aite-Novarica Group’s Fraud & AML service can download this report.