U.S. Core Banking Vendors: Who's Gaining Momentum?

Report Summary

U.S. Core Banking Vendors: Who's Gaining Momentum?

The U.S. financial industry has ignored the need to replace its core systems for too long, and is feeling the repercussions of quick-fix strategies.

Boston, MA, May 17, 2010 – A new report from Aite Group examines the demand for core system replacements among U.S. banks and credit unions, core system vendor momentum and market share, and changes in financial institution needs. It also analyzes the primary growth strategies of some of the leading U.S. core vendors and compares the depth and breadth of their overall product portfolios.

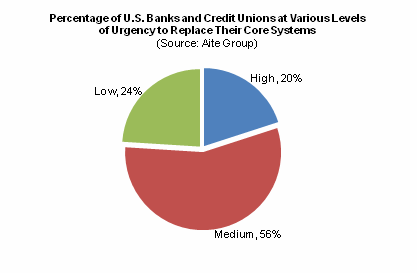

The U.S. financial industry has ignored the need to replace its core systems for too long, and is feeling the repercussions of quick-fix strategies that have masked underlying system problems. Aite Group estimates that approximately 20% of U.S. financial institutions have reached a high level of urgency regarding replacing their core systems, and as such risk losing business to more flexible competitors. An additional 56% of U.S. banks and credit unions would benefit from a core system replacement or transformation. Modern and open architectures enable easier access to data, quicker product launches, a more customized user experience, greater operational efficiencies, and real-time information. Because core systems replacements are very costly endeavors for financial institutions, it is important that financial institutions work with a core system vendor best suited to their specific needs.

"Aite Group is confident that the number of core system replacements at financial institutions will slowly begin to increase due to necessity as well as pent-up demand and the desire from healthy banks and credit unions to take advantage of new market opportunities," says Christine Barry, research director with Aite Group and author of this report. "To capitalize on the new business opportunities coming to market, it is essential that core vendors not only offer a broad portfolio of tightly integrated solutions, but that they implement a unified go-to-market strategy across their organization."

This report profiles and compares six of the leading U.S. core system vendors: CSC, FIS, Fiserv, Harland Financial Solutions, Jack Henry, and Open Solutions.

This 56-page Impact Report contains 32 figures and seven tables. Clients of Aite Group's Retail Banking and Wholesale Banking services can download the report.