Synthetic Identity Fraud: The Elephant in the Room

Report Summary

Synthetic Identity Fraud: The Elephant in the Room

Synthetic identity fraud is on the rise, and financial services firms need to improve their means of detection and remediation.

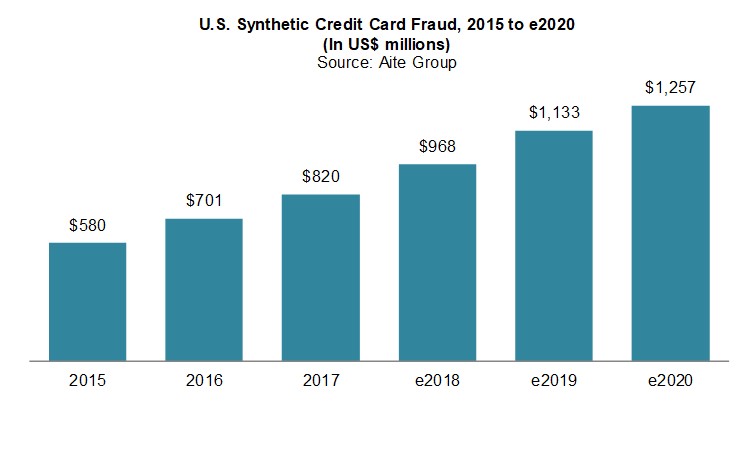

Boston, May 3, 2018 – Synthetic identity fraud in the U.S. is nothing new; however, modern criminals have been able to exploit the underpinnings of the current (admittedly flawed) personal identity regime to take synthetic identity fraud to a whole new level. As a result, this form of fraud is the new elephant in the room—a problem that is rising to epic proportions but that many have yet to acknowledge.

This Impact Note defines synthetic identity fraud, establishes a sizing for its impact on the U.S. credit card market, and discusses emerging vendor solutions. It is based on interviews with 33 executives from U.S. financial services firms and fraud vendors from July 2017 to April 2018.

This 21-page Impact Note contains three figures and eight tables. Clients of Aite Group’s Fraud & AML service can download this report, the corresponding charts, and the Executive Impact Deck.

This report mentions Accertify, ACI Worldwide, Acxiom, BAE Systems, BehavioSec, BioCatch, Bottomline Technologies, Brighterion, Danal, DataVisor, Early Warning Services, Emailage, Enova Decisions, Entrust Datacard, Equifax, Experian, Feedzai, FICO, FIS, Fiserv, Giact, IBM, ID Analytics, ID Insight, IdentityMind, iSoft, IDology, InAuth, iovation, LexisNexis Risk Solutions, Neustar, Nice Actimize, NuData Security, Oracle, Payfone, Risk Ident, RSA Security, SAS, Simility, Socure, ThetaRay, ThreatMetrix, TowerData, TransUnion, Vasco, Whitepages Pro, Wipro, Zoot, and Zumigo.