Financial Institution Fraud Trends: ATO and Application Fraud Rising Rapidly

Report Summary

Financial Institution Fraud Trends: ATO and Application Fraud Rising Rapidly

FIs should focus on improving security without sacrificing the customer experience.

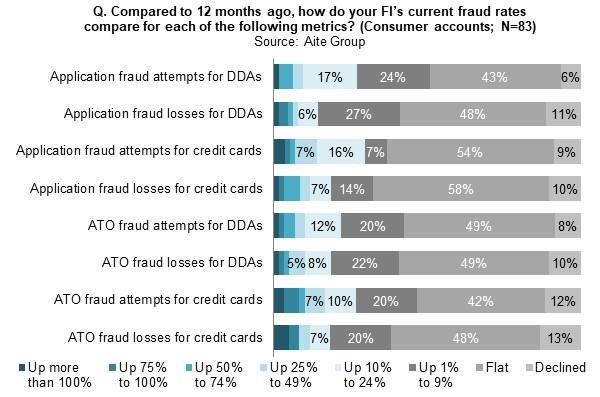

Boston, May 31, 2017 – Two big challenges for U.S. FIs currently are both identity-related threats—application fraud and account takeover fraud. Both of these fraud threats were initially fueled by the wealth of personal information available from so many data breaches, but fraudsters are becoming more sophisticated at aging the synthetic identities they create. Improved security doesn’t have to translate to greater friction for customers. Will FIs that focus on improving security and the customer experience have a competitive advantage as a result?

This report will examine the extent to which FIs are being impacted by these current fraud threats as well as the effect of a relatively new function in FIs that focuses on improving the customer experience. It is based on Aite Group surveys of 83 executives at U.S. FIs conducted in March and April 2017. Respondents work with FIs of many sizes, representing the full spectrum of U.S. FIs.

This 35-page Impact Report contains 26 figures and one table. Clients of Aite Group’s Fraud & AML service can download this report, the corresponding charts, and the Executive Impact Deck.

This report mentions Equifax.