Patient Finance: The Silver Bullet for U.S. Healthcare’s Bad Debt Problem?

Report Summary

Patient Finance: The Silver Bullet for U.S. Healthcare’s Bad Debt Problem?

The need for payment and financing solutions that improve collections and satisfy patients is urgent.

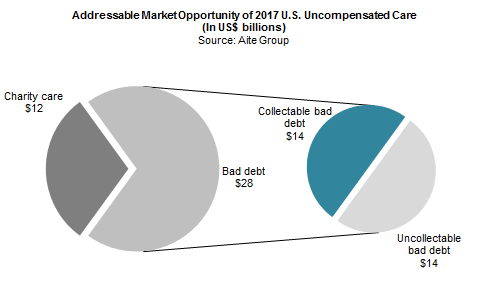

Boston, September 20, 2018 – The era of high-deductible health plans has brought a new actor onto the healthcare payments stage: the patient. Provider systems traditionally designed for collections through insurance companies are struggling to fit this new actor into their receivables and payments strategies. But financial technology vendors, payment processors, electronic bill presentment and payment companies, and several banks are poised to tackle the scourge of bad debt for hospitals.

This research explores the effect that the growing share of patient-paid revenue has on hospital and healthcare provider revenue and the patient payment options available to mitigate the risk of bad debt. It is based on phone interviews that Aite Group conducted with 40 decision-makers across technology partners, payment processors, financial lenders, healthcare providers, and U.S. hospitals throughout Q3 2018.

This 36-page Impact Report contains 14 figures and five tables. Clients of Aite Group’s Health Insurance service can download this report, the corresponding charts, and the Executive Impact Deck.

This report mentions CareCredit, CarePayment, ClearHealth Costs, Equifax, Experian Health, Healthcare Bluebook, Health Payment Systems, iVita Financial, LendingTree, MyMedical Shopper Parasail Health, and TransUnion Healthcare.