Establishing and Sustaining Data Mastery: Introducing the Banking Data & Analytics Maturity Model

Report Summary

Establishing and Sustaining Data Mastery: Introducing the Banking Data & Analytics Maturity Model

Data and analytics innovation requires technology, organizational change, and executive sponsorship.

June 7, 2023 – Data is an arms race. Competitive pressures, internal demands, and an ever-growing pool of data are driving banks to assess their data and analytics capabilities. In a business where it’s challenging to differentiate by product and services, data and analytics enable insurers to break free from commoditization with better and faster decisions.

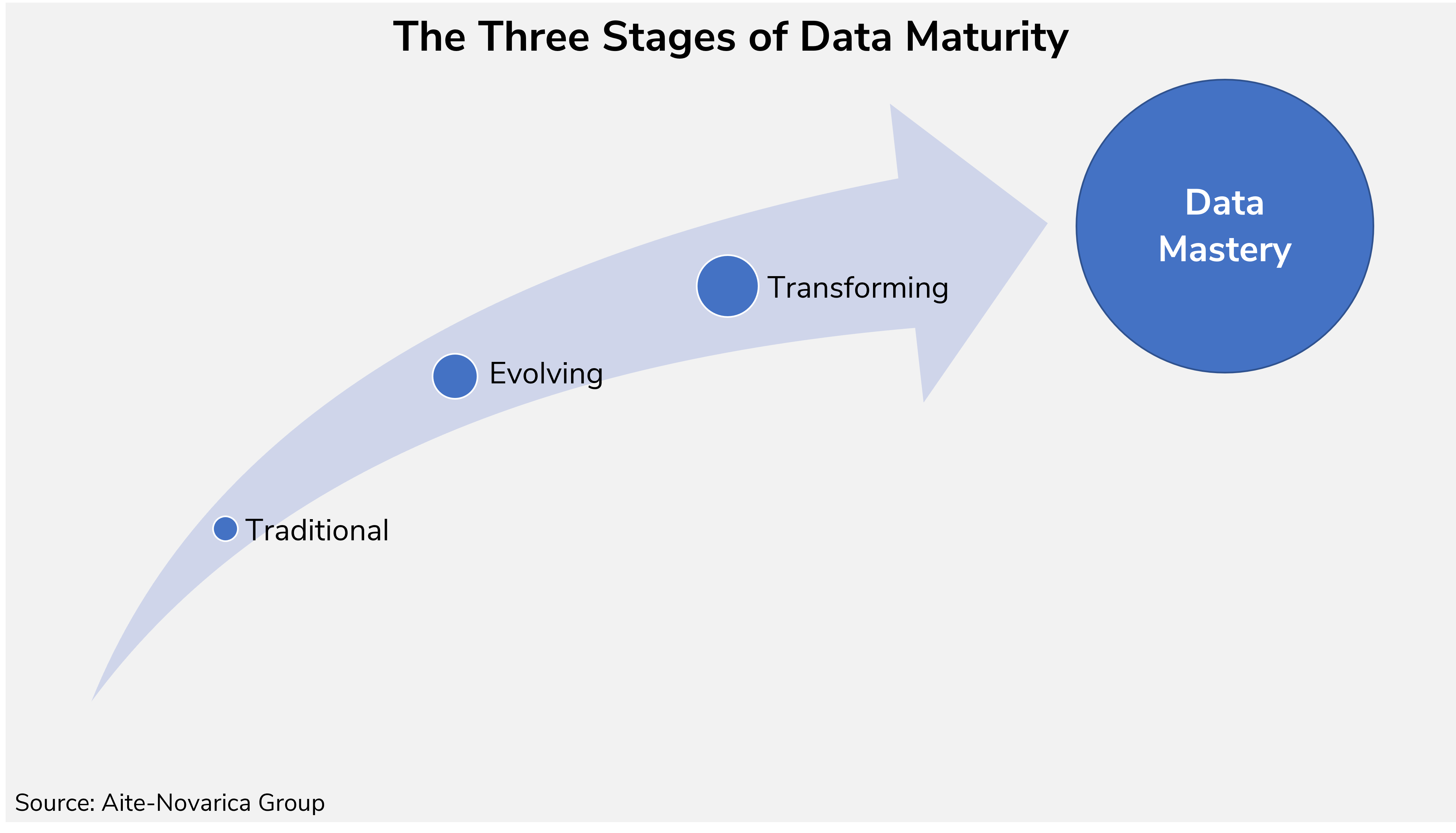

Aite-Novarica Group’s Banking Data & Analytics Maturity Model provides a framework for banks to evaluate their data-related capabilities. The report is based on the experience and observations of the authors and is bolstered by the thousands of conversations that Aite-Novarica Group has each year with banks.

Clients of Aite-Novarica Group’s Commercial Banking & Payments or Retail Banking & Payments service can download this report.

This report mentions FIS, Fiserv, and Jack Henry & Associates.