U.S. Neobanks: Challenging the Challengers

Report Summary

U.S. Neobanks: Challenging the Challengers

Digital banking enabled a new class of FIs to sprout—neobanks.

![]()

March 30, 2023 – Today’s banking environment looks much different than the first generation of online banks. A wide range of changing consumer digital habits, economic volatility, and recovery after the 2008 recession, the COVID-19 pandemic, and industry incumbency have enabled a newer generation of neobanks to sprout, with differing go-to-market strategies, models, customer bases, features, and functionality that make or break their success. This success, however, mostly lies on neobanks’ ability to convince consumers to break their habits and move away from their primary FI—no easy feat.

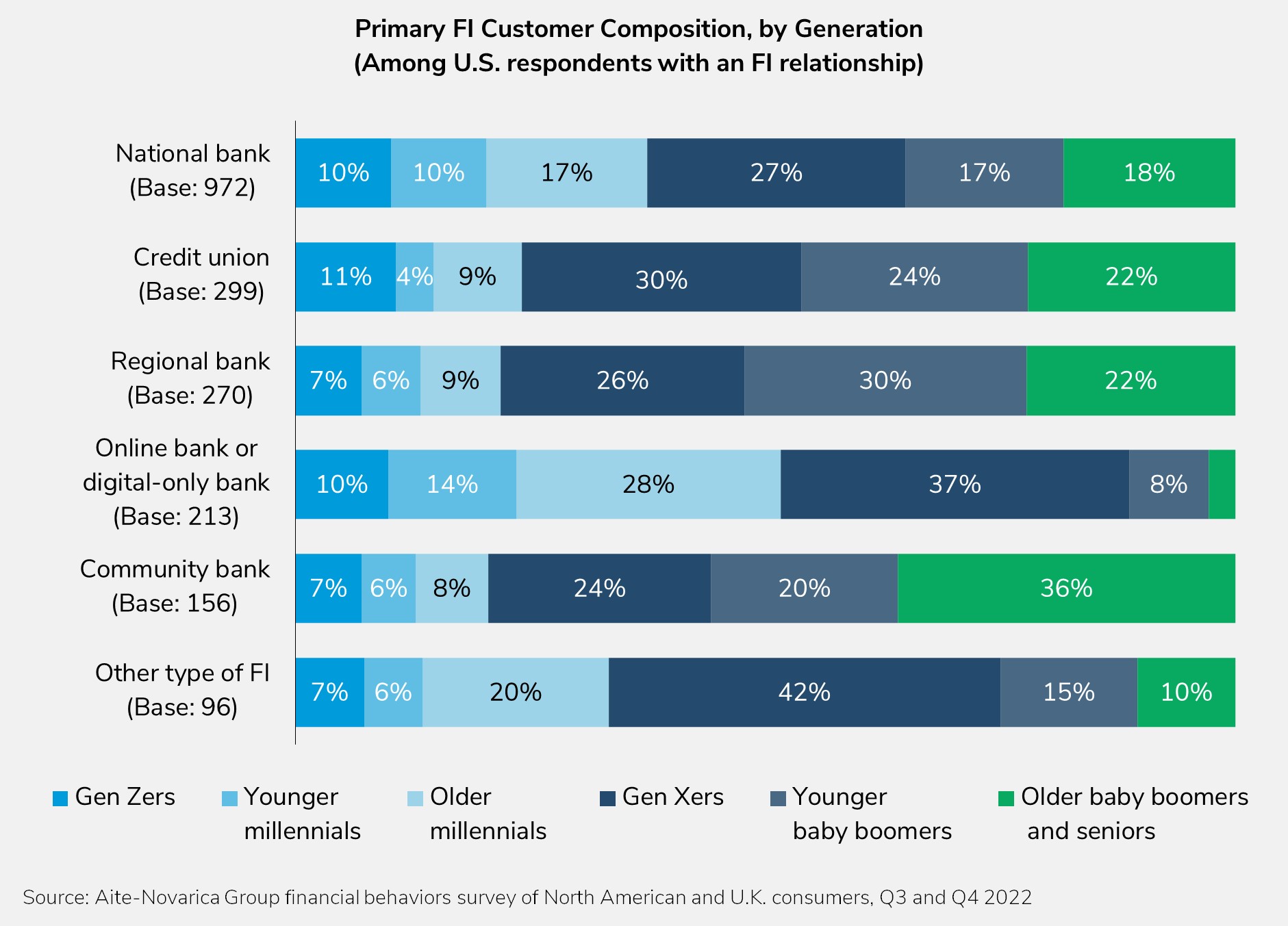

This Impact Report outlines the U.S. neobank market, focusing on key players, their market message, and how U.S. customers of neobanks’ financial behaviors compare to and contrast against the general banked U.S. population. This report is based on a study Aite-Novarica Group conducted in Q3 and Q4 2022 of 3,008 consumers in the U.S., Canada, and the U.K.

Clients of Aite-Novarica Group’s Retail Banking & Payments service can download this report.

This report mentions Acorns, ADP, Albert, Ally Bank, American Express, Aspiration, Bancorp Bank, BM Technologies, Block, Chime, Choice Financial Group, Community Federal Savings Bank, Credit Sesame, Current, Customers Bank, Dave, Evolve Bank & Trust, Fifth Third Bank, Green Dot, Greenlight, H&R Block, I2C, Lincoln Savings Bank, Marqeta, MoneyLion, Oxygen, Pathward, PayPal, SoFi, Stride Bank, Sutton Bank, Varo Bank, and Walmart.