The State of Cross-Border Money Transfers: An Update

Report Summary

The State of Cross-Border Money Transfers: An Update

Though business in the money transfer industry is picking up, revenue pressures remain, driving MTOs to seek new delivery channels.

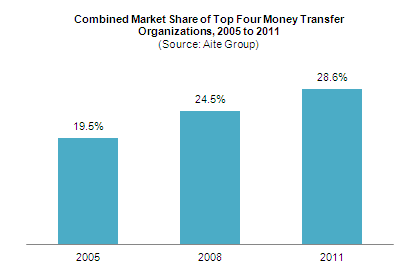

Boston, March 13, 2012 – A new report from Aite Group outlines the state of the cross-border money transfer industry and discusses the major market players, including their market share. Based on November 2011 to January 2012 Aite Group interviews with 40 banks and money transfer operators (MTOs), the report provides insight into market players’ impressions of market trends, including their views on emerging money transfer channels and the issues these channels face.

After a lackluster 2010, the money transfer market began to show modest growth in 2011. While progress is still far from stellar, industry participants believe this growth to be a harbinger of better days. Even so, many players remain wary of continuing pricing declines, margin compression, and rising costs in regulatory overhead, and are keeping an eye on opportunities to expand into new delivery channels—mobile and Internet portals and even ATMs—to replace older, more expensive channels.

“New delivery channels have not been adopted en masse by money transfer consumers, who are very comfortable with a more traditional, face-to-face way of conducting business,” says Adil Moussa, senior analyst with Aite Group and author of this report. “MTOs should offer new products and channels that seek to increase engagement, drive usage, and entice or reward consumers for their behavior; ATMs, Internet portals, and mobile wallets have the potential to change the face of the money transfer industry.”

The report references the following industry players: Coinstar, Dolex, Euronet, ICICI Bank, Intermex, La Nacional, MoneyGram, Omnex, Philippine National Bank, Remesas Quisqueyana, Sigue, Transfast, UAE Exchange, Uniteller, Wells Fargo, Western Union, and Xoom.

This 28-page Impact Report contains five figures and one table. Clients of Aite Group’s Retail Banking service can download the report.