Special Bonds That Tie Bank Broker-Dealers to Parent Banks: Something’s Got to Give

Report Summary

Special Bonds That Tie Bank Broker-Dealers to Parent Banks: Something’s Got to Give

October 6, 2022 – The main client acquisition opportunity for bank broker-dealers is cross-selling to the bank’s retail client base. Yet, those retail banking customers already have investments and advisor relationships elsewhere. Bank broker-dealers need competitive value propositions to win clients over national, regional, and online broker-dealers. For many, digital channels are just that.

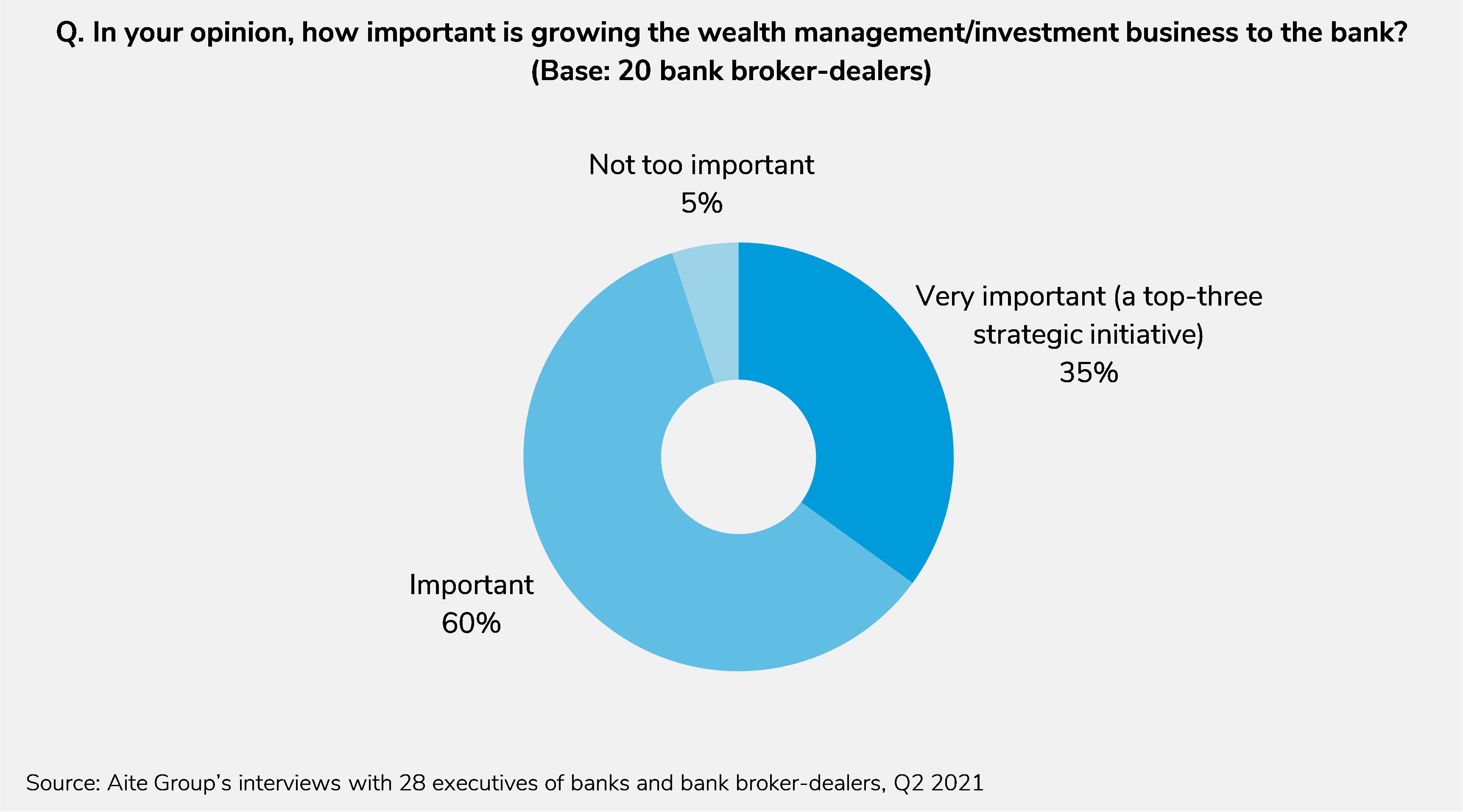

This Impact Report analyzes the drivers affecting bank-affiliated wealth management firms and how Aite-Novarica Group expects these entities to grow in a digital, high-interest rate environment. Aite-Novarica Group conducted qualitative interviews with 28 bank broker-dealer executives and bank executives, supplemented with a short quantitative survey and other Aite-Novarica Group research.

This 35-page Impact Report contains 15 figures and two tables. Clients of Aite-Novarica Group’s Wealth Management and Retail Banking & Payments services can download this report and the corresponding charts.

This report mentions Ally, Bank of America, Betterment, Cetera, Fidelity, Infinex, LPL, Raymond James, Schwab, SoFi, and USAA.