Print on Demand: Driving Usage and Customer Retention Through Custom Cards

Report Summary

Print on Demand: Driving Usage and Customer Retention Through Custom Cards

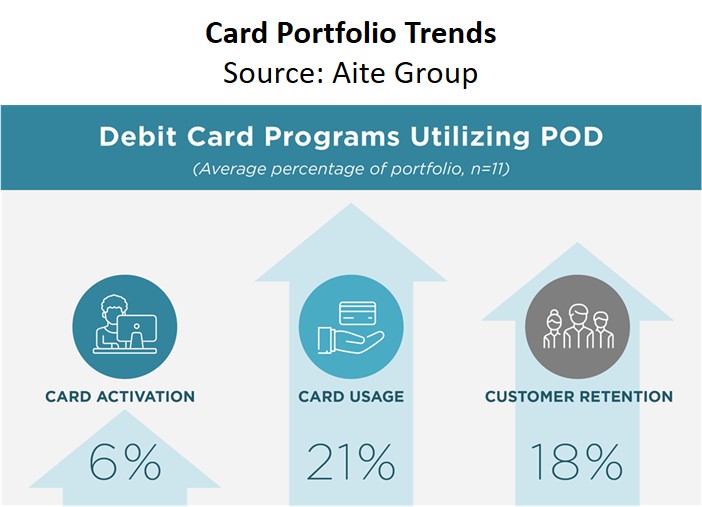

For banks that effectively market it, POD leads to increases in card activation, usage, and customer retention.

Boston, August 16, 2018 – With the influx of the millennial generation, which expects innovative solutions and real-time delivery, the combination of instant issuance and print on demand—providing debit or credit cards with customer-selected images—is hitting its stride. The majority of the top 50 U.S.-based card issuers offer some form of customized card, and a remarkable percentage of smaller financial institutions utilize the product as well.

This report looks at how FIs in the U.S. leverage POD for both personal and small-business debit and credit card applications, how the programs are marketed in various channels, and some of the key metrics utilized to understand the impact of the product on customer retention and spending behavior. It is based on 20 Aite Group interviews conducted in June and July 2018 with product and marketing professionals across various FIs in the U.S.

This 16-page Impact Report contains five figures and two tables. Clients of Aite Group’s Retail Banking & Payments service can download this report, the corresponding charts, and the Executive Impact Deck.