Peeling Back the Layers of the ESG Data, Ratings, and Analytics Vendor Landscape

Report Summary

Peeling Back the Layers of the ESG Data, Ratings, and Analytics Vendor Landscape

Solutions providers offering data, analytics, and other tools to manage ESG data are among the most dynamic players in the market.

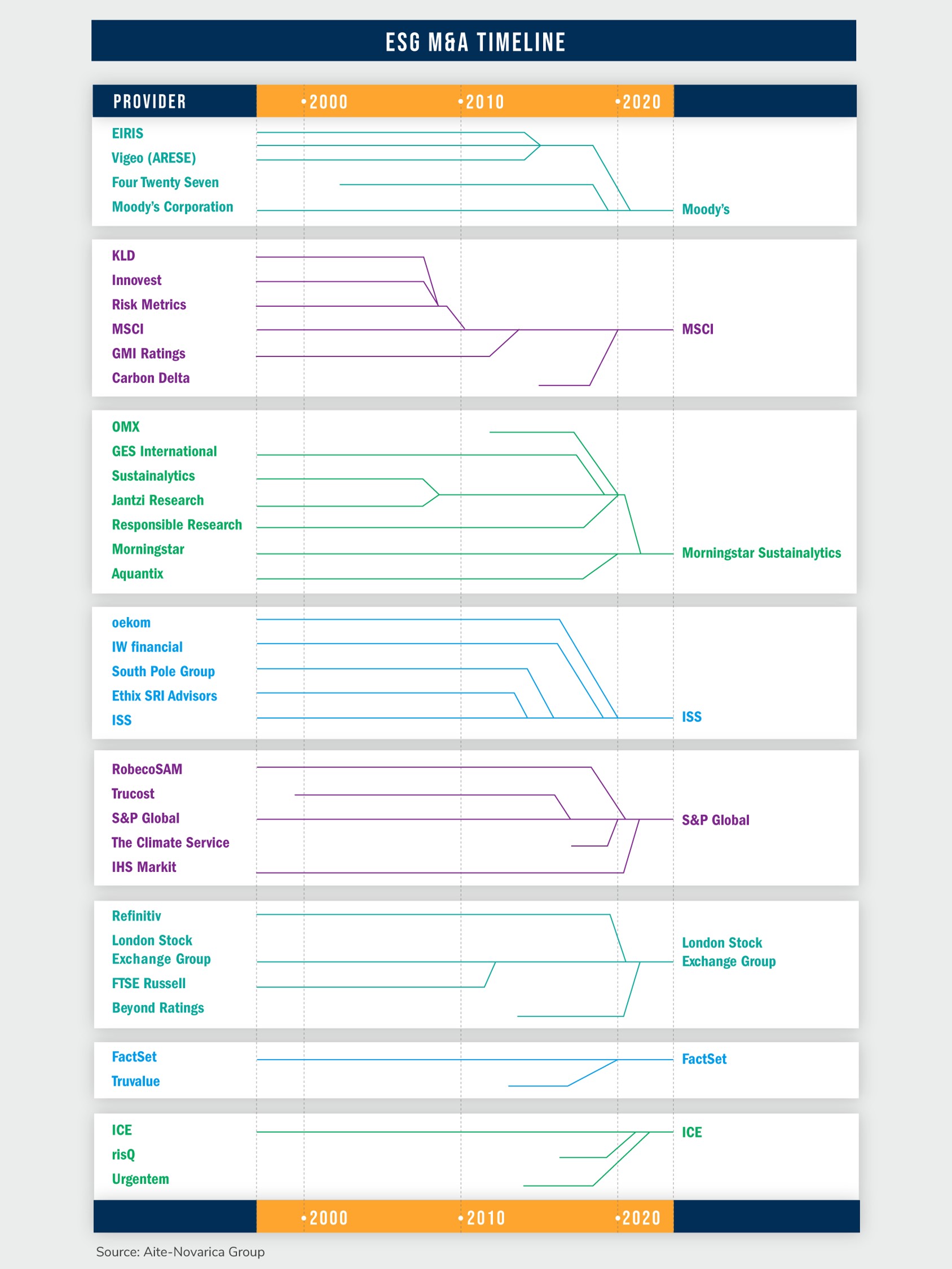

May 25, 2023 – The environmental, social, and corporate governance (ESG) data, ratings, and analytics needs of buy-side institutions continue to evolve as new products enter the market and regulatory reporting requirements expand across major financial jurisdictions. Third-party vendors of all shapes and sizes have flooded the market with solutions to meet this demand, creating an intertwined, crowded, and sometimes confusing vendor landscape.

This report—which is part of a series of ESG vendor reports—profiles 10 of the industry’s major providers, including information on their offerings, client bases, and data coverage. It is based on ongoing Aite-Novarica Group research on the role ESG data and analytics play in the capital markets industry. This report profiles the following vendors: Bloomberg, FactSet, Intercontinental Exchange (ICE), ISS ESG, London Stock Exchange Group, Moody’s, MSCI, RepRisk, S&P Global, and Sustainalytics.

Clients of Aite-Novarica Group’s Capital Markets service can download this report and the corresponding charts.

This report mentions Amazon Web Services, Beyond Ratings, BlackRock, BNY Mellon Data and Analytics, Carbone 4, Crux Informatics, Denominator, Deutsche Borse, FTSE Russell, GoldenSource, Morningstar, Microsoft, PitchBook, Qontigo, Rimes Technologies, SimCorp, SIX Financial, Snowflake, State Street, and Yield Book.