The Mobile Banking Opportunity for Small Businesses — Are Banks Listening?

Report Summary

The Mobile Banking Opportunity for Small Businesses — Are Banks Listening?

Boston, MA, December 1, 2008 – A new report from Aite Group, LLC reveals the small-business appetite for mobile banking. Based on Aite Group's November 2007 survey of 303 small businesses, and a separate survey of 50 of the largest U.S. financial institutions conducted between July and September 2008, the report shows the degree to which small businesses desire mobile banking services, and how strong banks perceive that desire to be.

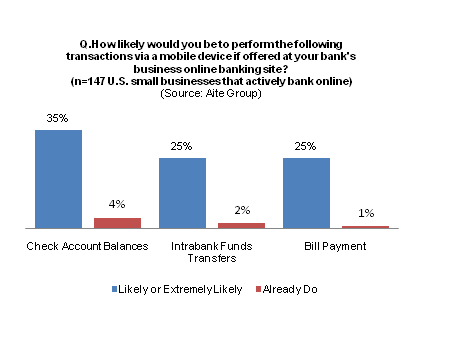

Small-business owners are attracted to financial products and services that save them money or increase convenience. More than 60% of small businesses currently bank online, and are showing a greater demand for multichannel banking, including mobile banking services. In fact, approximately one-third of those interviewed expressed a likelihood that they will use mobile banking; nearly 10 times the likelihood expressed by credit and debit cardholders in a similar Aite Group survey. Banks cannot ignore this statistic. Unlike retail banking customers that have been universally provided with free mobile banking, small businesses can and do pay for a number of banking services. Mobile banking for small businesses could be a revenue generator for banks.

"Small businesses clearly show a need for mobile banking, and the segment offers banks a real opportunity to monetize the service - something that has remained largely elusive thus far," says Nick Holland, senior analyst with Aite Group and co-author of this report. "Mobile is an efficient channel, facilitating saved time and expense for people who already have little spare time and money . Banks cannot simply offer the same mobile banking services that are currently offered to retail banking customers, however. Instead, they should carefully assess small-business pain points that can be relieved via a mobile interface."

This 13-page Impact Note contains seven figures. Clients of Aite Group's Wholesale Banking service can download the report