Cross-Border Money Transfers: A Sizing Update

Report Summary

Cross-Border Money Transfers: A Sizing Update

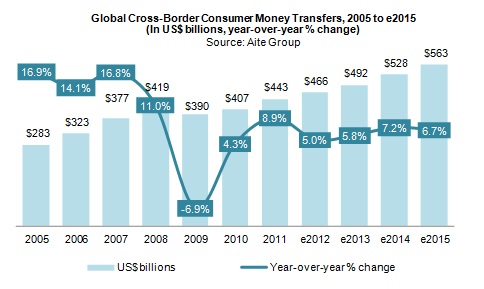

Global cross-border consumer money transfers grew from US$443 billion in 2011 to an estimated US$466 billion in 2012, and they are set to reach US$492 billion by 2013.

Boston, February 11, 2013 – A new report from Aite Group updates its sizing of global cross-border consumer money transfers, reveals the top 20 countries ranked by inbound worker remittances for 2012, and forecasts transaction growth.

Participants in cross-border consumer money transfers find themselves operating in an increasingly challenging environment. Continued pricing pressures due to fierce competition, increased regulations that add costs for money transfer organizations (e.g., U.S. Dodd-Frank Act, Section 1073), and growing options for consumers to move money means that MTOs have less and less margin for error.

“Intense price competition represents the number-one barrier to entry for new entrants to today's money transfer business, ahead of other issues such as compliance, technology, and branding,” says Gwenn Bézard, co-founder of and research director with Aite Group and author of this report. “New entrants should not overestimate their ability to profitably undercut agent-based MTOs' pricing using new channels.”

This 17-page Impact Note contains 13 figures. Clients of Aite Group’s Retail Banking service can download the report.