The Buy-Side Perspective of Algorithmic Trading, 2020: Amid the Chaos

Report Summary

The Buy-Side Perspective of Algorithmic Trading, 2020: Amid the Chaos

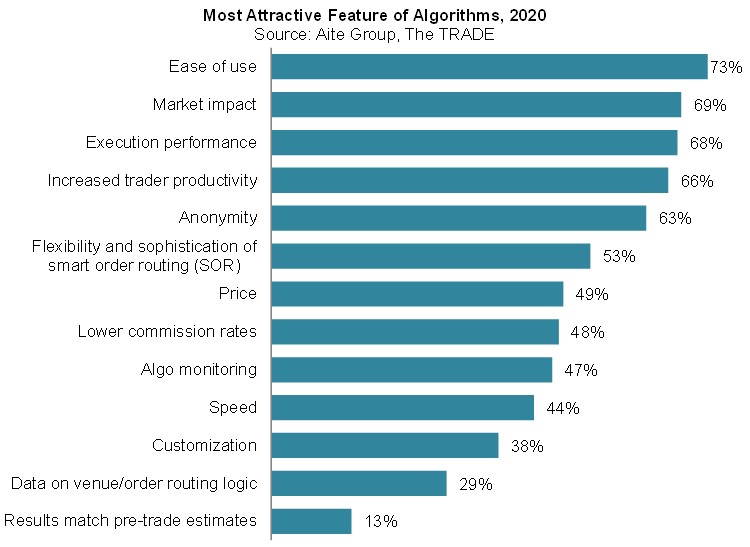

The efficiency, consistency, and ease of use in transacting orders continue to resonate with traders.

Boston, July 23, 2020 – The toolbox of available e-trading choices has continued to evolve and bring a greater sophistication of offerings in 2020. Providers of algorithmic trading strategies are developing a bevy of new algos in addition to those that have become standard offerings, and market structure and asset class development are underpinning greater potential for algo adoption across asset classes.

This report provides insights into algorithmic trading, including the key market trends, algo provider selection criteria, and overall customer satisfaction for algo-related services. Based on data collected as part of The TRADE’s 2020 Algorithmic Trading Survey, it compares previous years’ survey results to 2020 results, highlights requirements going forward, and identifies how the algorithmic e-trading business is changing.

This 34-page Impact Report contains 24 figures and five tables. As part of Aite Group’s Partner Research initiative, this report is available for purchase only and is not part of Aite Group’s research offering. If interested in purchasing the report, please contact us.

This report mentions Bank of America, Barclays, Bernstein Trading, BNP Paribas, Credit Suisse, Citi, Exane, Goldman Sachs, Instinet, Jefferies, J.P. Morgan, Kepler Cheuvreux, Liquidnet, RBC Capital Markets, Redburn, Societe Generale, UBS, and Virtu.