Boston, July 2, 2020 –The COVID-19 pandemic has impacted every aspect of the daily workflow for employees in capital markets firms across the globe. Trading desks will not be the same—the work-from-home culture has accelerated the digital transformation across all functions in banks and buy-side firms. The aftermath has left firms wondering how they should tackle the use of technologies in various business units. For example, should firms shift undifferentiated heavy-lifting tasks to tech vendors and focus on the core business?

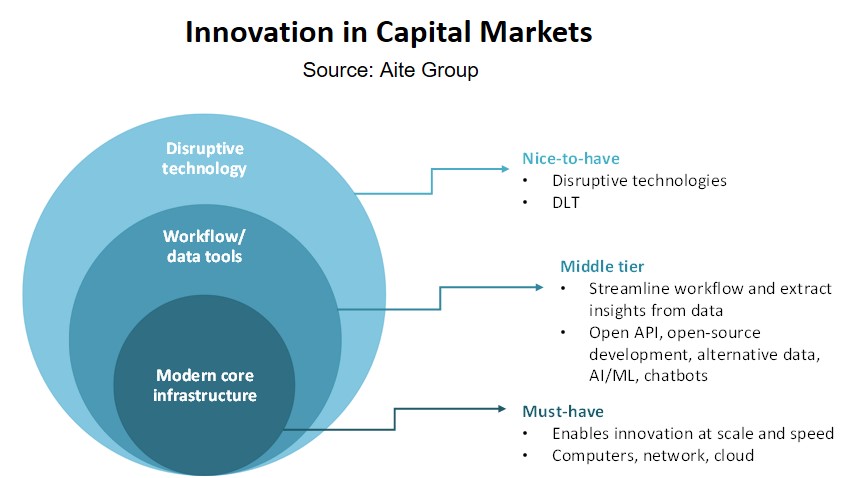

This Impact Report examines top trends in innovation, including cloud, open APIs, alternative data, AI/ML, application (app) interoperability, chatbots, outsourced trading, and DLT. It is based on Aite Group interviews, conducted in the first half of 2020, with leading market participants across the globe, representing investment banks, technology vendors, and financial technology innovation hubs.

This 33-page Impact Report contains eight figures and three tables. Clients of Aite Group’s Institutional Securities & Investments service can download this report, the corresponding charts, and the Executive Impact Deck.

This report mentions Advan, AWS, Axioma, Bloomberg, Charles River, DTCC, Digital Asset, Equinix, Goldman Sachs, IHS Markit, JPMorgan, OpenFin, RavenPack, Refinitiv, Symbiont, Symphony, Tradeweb, and Vanguard.

About the Author

Datos Insights

We are the advisor of choice to the banking, insurance, securities, and retail technology industries–both the financial institutions and the technology providers who serve them. The Datos Insights mission is to help our clients make better technology decisions so they can protect and grow their customers’ assets.