Autonomous Vehicle Insurance: Time to Act

Report Summary

Autonomous Vehicle Insurance: Time to Act

Insurers failing to actively shape legislation and regulation regarding autonomous vehicles are making a mistake.

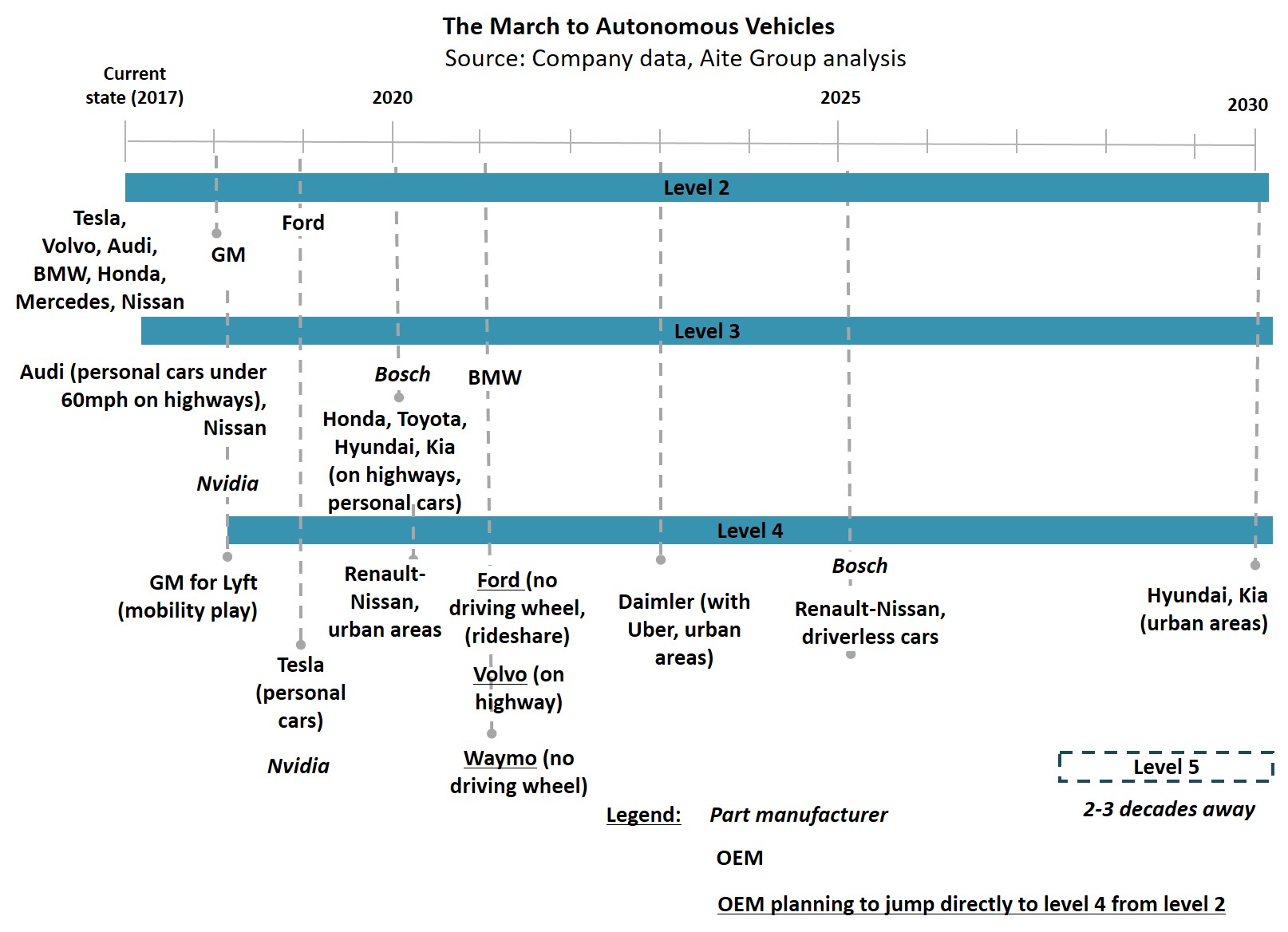

Boston, November 21, 2017 – Original equipment manufacturers and tech companies are racing to deliver vehicles with ever higher levels of autonomous capability. Insurers in some countries have worked or are working to influence legislation (e.g., the United Kingdom), while insurers in other countries have exerted little concerted effort thus far (e.g., the United States). But insurers must come together as an industry, define a common position on critical issues related to the insurance of AVs, and lobby legislators and regulators accordingly.

This report discusses OEMs’ current march toward higher levels of automation, consumers’ attitudes toward AVs, the challenges facing insurers, and how U.K. insurers have approached the problem thus far. Based on over 40 interviews with insurers, OEMs, vendors, and regulators across North America and Europe conducted between August and November 2017, and on Aite Group microsurveys of online U.S. consumers conducted in October 2017, it concludes with recommendations for the insurance industry.

This 30-page Impact Report contains 14 figures and one table. Clients of Aite Group’s P&C Insurance service can download this report, the corresponding charts, and the Executive Impact Deck.

This report mentions Agero, Allianz, Alphabet's Waymo, Amazon, Amodo, Audi, Autoliv, Aviva, Axa, BMW, BNP Paribas Cardif, Bosch, Daimler, Delphi, European Automobile Manufacturers’ Association (ACEA), Ford, Getaround, GM, Honda, Hyundai, Insurance Information Institute (III), Jaguar, Kia, Land Rover, LexisNexis Risk Solutions, Liberty Mutual, Lyft, Mercedes-Benz, Microsoft, MIT Agelab, NAIC, Nissan, Nvidia, Pack’n Drive, Phrame, PostNord, PSA, QBE, Renault-Nissan, Root Insurance, Smartcar, Tesla, Touchstone Evaluations, Toyota, Turo, Uber, Verisk, and Volvo.