Aite Matrix: Multi-Asset Buy-Side Risk

Report Summary

Aite Matrix: Multi-Asset Buy-Side Risk

May 12, 2022 – Risk management is a critical part of the investment process that can act as an independent function to ensure compliance with regulations and client mandates. Risk providers face greater requirements to provide a portfolio analytics package, including performance attribution and portfolio optimization capabilities. Some firms prefer a strategy of consolidating front-middle or front-back technology with risk management inclusive of broader capabilities. These consolidation pressures set expectations of risk systems and make it imperative for risk management platforms to continue to stand out in these functions. Expectations include continued model innovation and broad asset coverage, expansion into private asset classes and models, ESG risk analytics, and providing stable experiences and performance at scale.

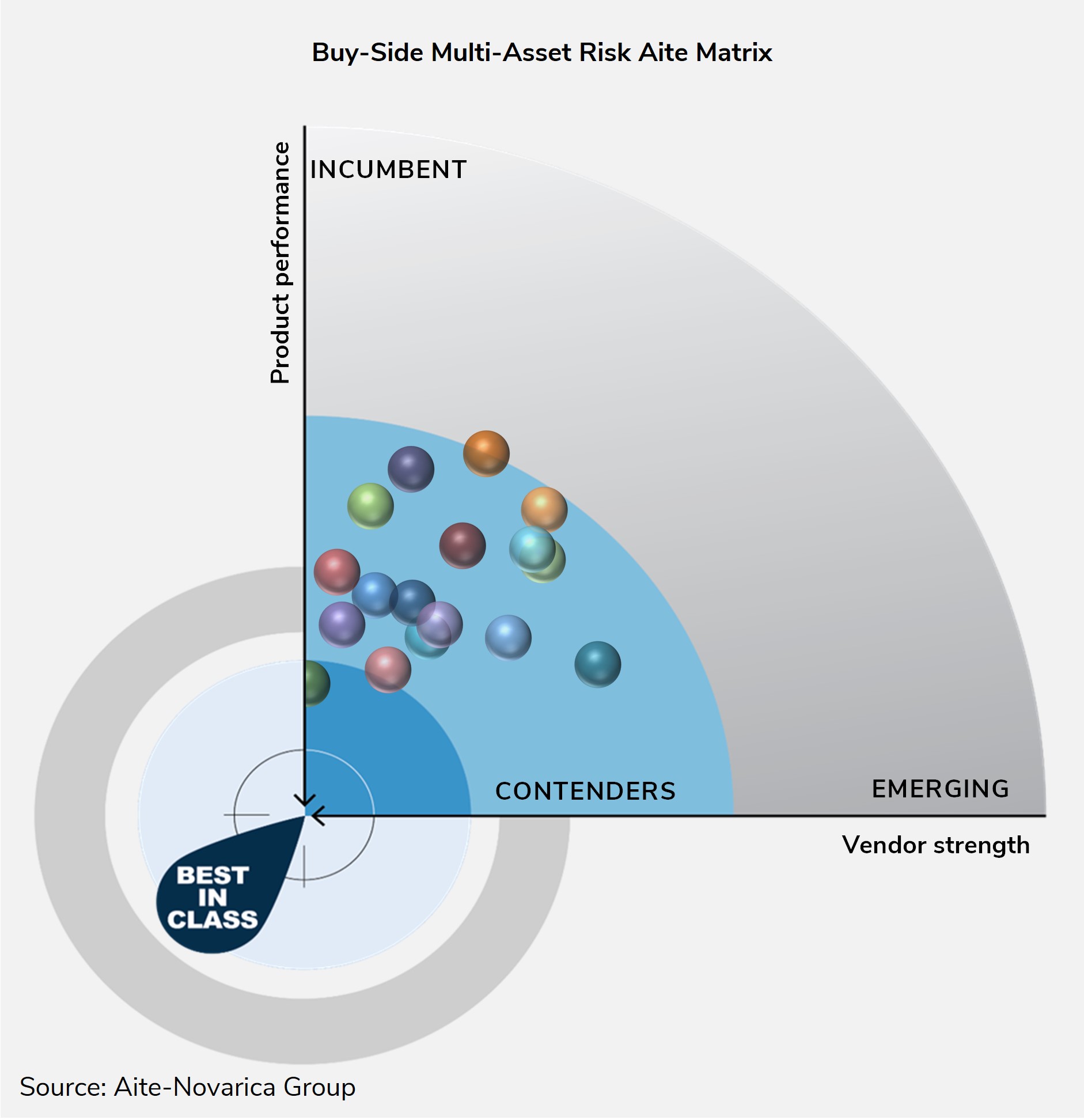

This report explores some of the key trends within the buy-side multi-asset risk market and discusses the ways technology is evolving to address new market needs and challenges. Leveraging the Aite Matrix, a proprietary Aite-Novarica Group vendor assessment framework, this Impact Report evaluates the overall competitive position of 17 vendors, focusing on vendor stability, client strength, product features, and client services. These 17 vendors are Adenza Group (Calypso Technology), BlackRock, Bloomberg, Confluence, FactSet, Finastra, FIS, MSCI, Murex, Northstar Risk, Numerix, Orchestrade, Qontigo, Quantifi, SS&C Technologies, TS Imagine, and Wilshire Associates. This report also profiles Broadridge, FINCAD, and Moody’s Analytics.

This 158-page Impact Report contains 18 figures and 24 tables. Clients of Aite-Novarica Group’s Capital Markets service can download this report and the corresponding charts.

This report mentions Accenture, AWS, Capco, Cognizant, Deloitte, Deutsche Boerse Group, DEVnet, D-fine, DXC, EY, First Derivatives, IHS Markit, Infosys, KPMG, Limina, Microsoft, Oracle, Phi Partners, State Street, Synenchron, Tesselate, and UBS.