Many insurers and reinsurers today are using some combination of Excel and legacy systems to manage their reinsurance business. For carriers wishing to invest in more automated, efficient processes, some modernized options continue to develop as reinsurance begins to catch up to other branches of the insurance industry. These solutions can address a variety of insurer needs, including better business intelligence and data analysis, prevention of claims leakage, and improved operational efficiency.

Many insurers and reinsurers today are using some combination of Excel and legacy systems to manage their reinsurance business. For carriers wishing to invest in more automated, efficient processes, some modernized options continue to develop as reinsurance begins to catch up to other branches of the insurance industry. These solutions can address a variety of insurer needs, including better business intelligence and data analysis, prevention of claims leakage, and improved operational efficiency.

Some of the key factors affecting this market include basic system capabilities, technology, and internationalization. In evaluating options for reinsurance management system upgrades, carriers should keep in mind the complexity and variation of their existing contracts as providers’ systems vary in levels of automation for reporting as well as premium and commission calculations.

In addition, newer systems have obtained and gone into production with more clients, and older systems have rolled out newer versions with modern code in recent years. This means that carriers previously waiting for a modern option with an established client base can feel confident in today’s market. Finally, reinsurance system vendors have a broad international reach, so insurers should stay tuned in to date/currency/language discrepancies and native support for North-American-specific regulatory reporting.

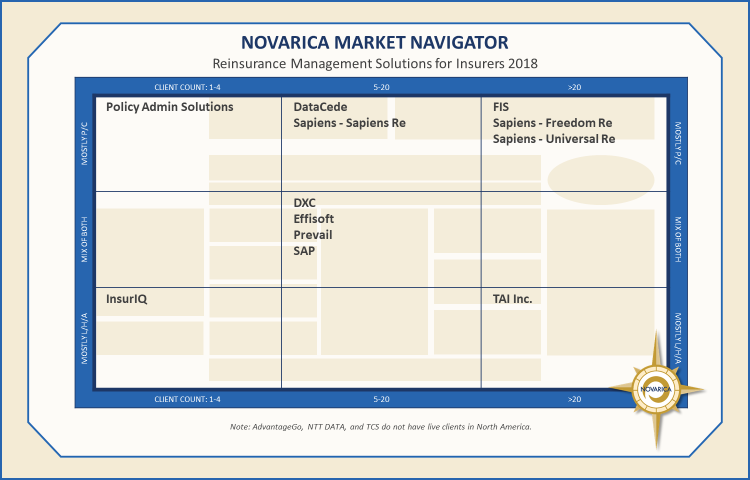

Novarica’s recent Reinsurance Management Market Navigator provides an overview of the current solution provider marketplace for reinsurance management solutions and is designed to help insurers come up with their short lists of potential providers. Key reinsurance management system features addressed in the report include the following:

- Core Focus. Reinsurance management systems are sold to insurers to handle both their ceded business and their assumed business. All vendors profiled in the report support ceded management, and many have support for assumed management.

- Contract Management. Reinsurance management systems need to be able to track and manage a variety of contracts, both treaty and facultative. These systems must be flexible in customizing and maintaining contracts between insurers and reinsurers.

- Reinsurance Interfaces. Some interfaces that reinsurance management systems may use include an end-user interface, an underwriter and claims interface, and a reinsurer integration interface.

- Reporting. Automated recoverable claims identification, tracking receivables and payables, statutory and regulatory reporting, and ad hoc reporting are all important features of these systems to consider.

- General Components. Other general components are often included in a reinsurance management system, such as document management capabilities for contract storage and entity management for tracking demographic information.

As insurers have been driven to simplify their processes and systems over the last few years, there are plenty of modern reinsurance options available in the current market which have a large enough production client base to demonstrate capability and stability. Novarica recommends that insurers choosing a reinsurance management system provider focus on four main criteria: staff, organization, functionality, and technology. For more information on current reinsurance systems providers, see this year’s Market Navigator on Reinsurance Management.

Comments

We're trialling Supercede -

Add new comment