The U.S. P2P Payments Market: Surprising Data Reveals Banks Are Missing the Mark

Report Summary

The U.S. P2P Payments Market: Surprising Data Reveals Banks Are Missing the Mark

At least 66% of U.S. adults engaged in person-to-person payments during 2022.

June 15, 2023 – People have exchanged some form of “money” with others since the dawn of time, and currency, or cash, remained king for years, but as with other payment categories, it has been replaced with alternative methods. Today, consumers have myriad options at their disposal to make P2P payments. Cash is still a popular option, but consumers are increasingly embracing a variety of electronic payment methods, including account-to-account transfers, alternative P2P payment services, e-gift cards, and cryptocurrency.

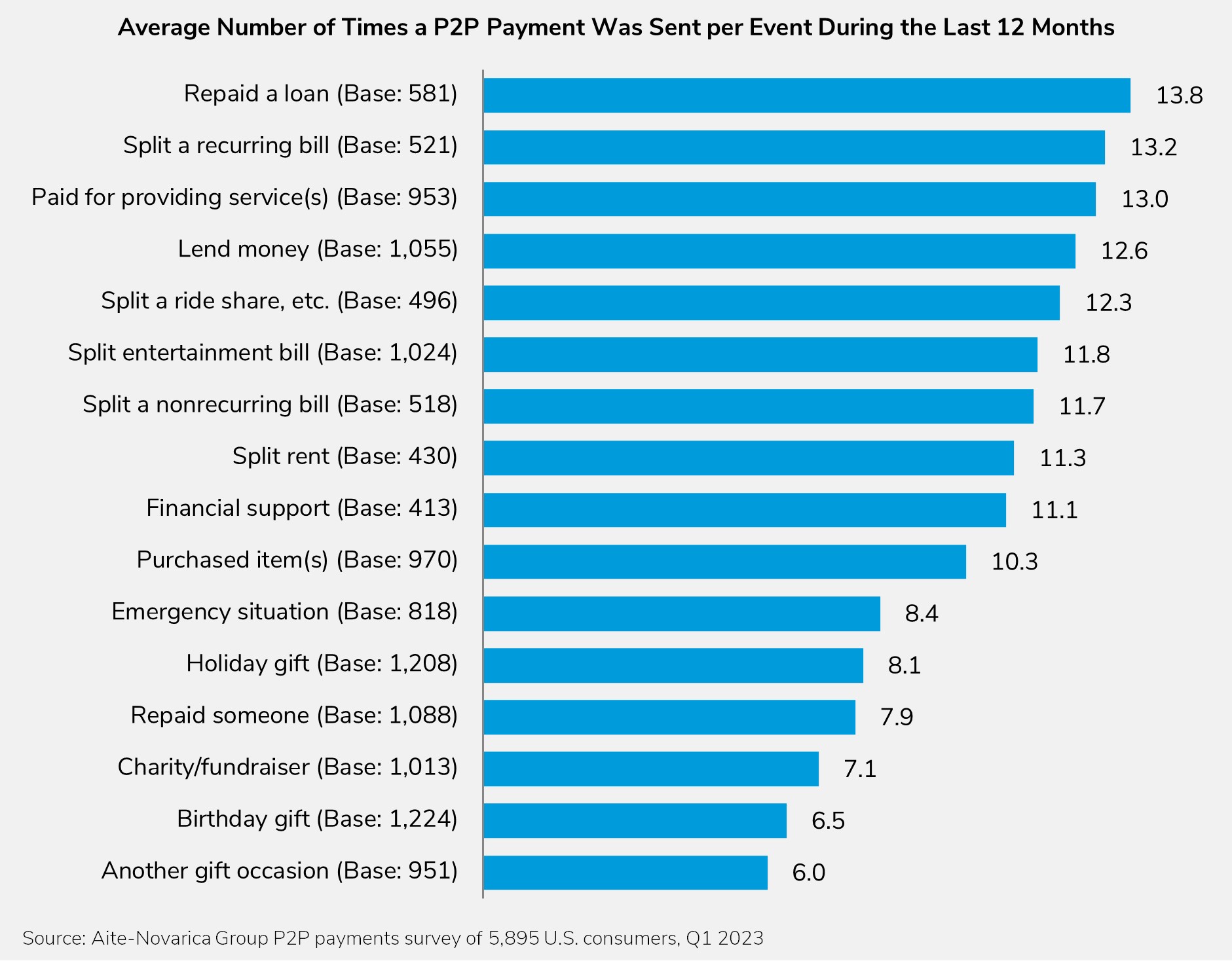

This report highlights key findings from this survey and is written so payment providers can better support their customers and grow their payments volume. It is based on an Aite-Novarica Group survey of 5,895 consumers in the U.S. in Q1 2023.

Clients of Aite-Novarica Group’s Retail Banking & Payments service can download this report.