Retail FX Traders: Pilgrims to the Land of High Returns

Report Summary

Retail FX Traders: Pilgrims to the Land of High Returns

The diverse world of retail FX requires that vendors be able to craft compelling messages tailored to specific geographies and unique demographic traits.

Boston, May 17, 2011 – A new report from Aite Group provides insight into the characteristics, location, and behavior of retail foreign exchange (FX) traders worldwide and identifies three major drivers for FX account growth into 2030. The report also compares how various retail FX traders view expected returns and how their demographic makeup differs from that of stock traders in the United States, Europe, and Japan.

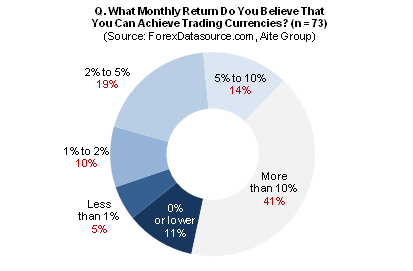

The five-fold growth of traders with funded retail FX accounts since 2005 has caught many by surprise. The main driver of this growth is the sizeable monthly return that traders expect from the FX market. The diversity of the retail FX community, however, requires that firms serving this market be able to craft compelling messages tailored to specific geographies and unique demographic traits.

“Though practical, treating FX as an ‘add-on’ product is not the best way to attract a critical mass of traders,” says Javier Paz, senior analyst with Aite Group and author of this report. “The demand for retail FX services is large enough to sustain a separate division dedicated to FX within securities firms and banks serving the space, and FX is specialized enough to warrant separate marketing and operational efforts. Given the cost to acquire new customers, entities that serve the retail FX market would be well advised to understand their customers and provide the tools and features they most desire.”

This 71-page Impact Report contains 80 figures and three tables. Clients of Aite Group's Wealth Management service can download the report.