New Realities in Wealth Management: Ready for the Sea Change?

Report Summary

New Realities in Wealth Management: Ready for the Sea Change?

Boston, MA, July 27, 2009 – A new report from Aite Group, LLC examines current changes taking place in the U.S. wealth management market. The report examines changes in market share, asset flows and advisor movement at wirehouses, independent broker/dealers, independent registered investment advisors and online brokerage firms. The report also profiles five wealth management organizations currently being affected by these market changes, and considers their business models, competitive positioning and key challenges.

The financial crisis has brought rapid and drastic change to the wealth management industry. In addition to experiencing severe drops in asset valuations and fee revenues since the beginning of the crisis, wealth management firms are being forced to rethink their strategic positioning in order to remain competitive. To complicate matters, many wealth management firms are finding themselves in mergers-and-acquisitions situations and are preoccupied with large-scale integration projects. It is safe to assume that the post-crisis wealth management landscape in the United States will look nothing like it did just a few short years ago.

"The U.S. wealth management market has seen an unprecedented flow of assets and advisors between firms and industry segments within the last 15 months," says Alois Pirker, research director with Aite Group and co-author of this report. "While nearly all wealth management firms have been confronted with sharp drops in client assets due to the market crash, those firms that have been able to attract new advisors have been able to replace a significant share of these assets."

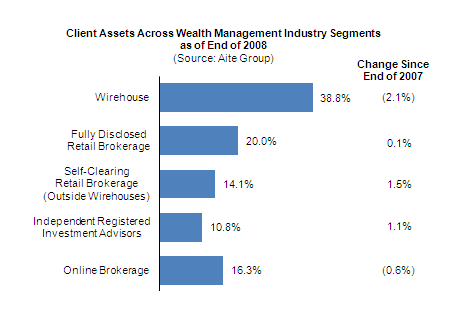

"Our market data suggests a significant shift toward both the independent advice model and use of self-directed brokerage platforms," adds Douglas Dannemiller, senior analyst with Aite Group and co-author of this report. "As a result, the independent broker/dealer and registered investment advisor segments have both gained market share at the expense of the dominant wirehouse firms."

The wealth management firms profiled in this report are Bank of America/Merrill Lynch, Charles Schwab, Fidelity Investments, LPL Financials and Wells Fargo.

This 41-page Impact Report contains 24 figures. Clients of Aite Group's Wealth Management service can download the report.