Nationally Recognized Statistical Ratings Organizations: Nothing Lasts Forever

Report Summary

Nationally Recognized Statistical Ratings Organizations: Nothing Lasts Forever

NRSRO hegemony may wane in the face of investor displeasure and proposed regulation.

Boston, MA, February 22, 2010 – A new report from Aite Group, LLC examines the role that Nationally Recognized Statistical Ratings Organizations (NRSROs) play in the debt issuance and investment process, and looks at pending regulations and possible credit rating agency (CRA) responses to these regulations.

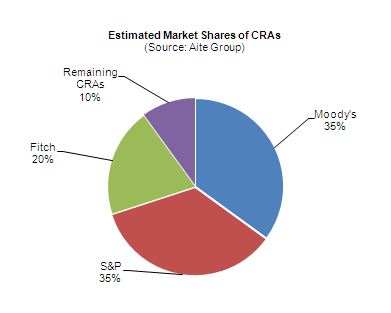

Historically, CRAs have measured the financial strength (i.e., provided gradations of creditworthiness) of corporations that have tapped publicly traded debt markets to finance their operations. Because of recent write-downs and expected losses - primarily related to mortgage-related securitized debt - credit rating agencies have taken a hit to their reputation for providing credible credit analysis. These SEC-sanctioned credit rating agencies (known as NRSROs), comprise 10 firms, including Moody's Investors Service, Standard & Poor's, and Fitch Ratings, which have for years held onto their constituent firms with a near-monopoly grip. Nothing lasts forever. Investor dissatisfaction with NRSROs, and drafted regulation, such as the Restoring American Financial Stability Act have primed the playing field for major changes.

"While NRSRO ratings will remain a part of the global debt markets, NRSRO hegemony may wane in the face of proposed legislation and investor displeasure," says John Jay, senior analyst with Aite Group and author of this report. "Consequently, NRSROs will need to share their sandbox with other credit ratings agencies, and even investors themselves. More than any other party, investors have some ability to look out for their own interests by taking credit analysis onto their own shoulders."

This 16-page Impact Note contains seven figures and two tables. Clients of Aite Group's Institutional Securities & Investments service can download the report.