Market Data Infrastructure Challenges

Report Summary

Market Data Infrastructure Challenges

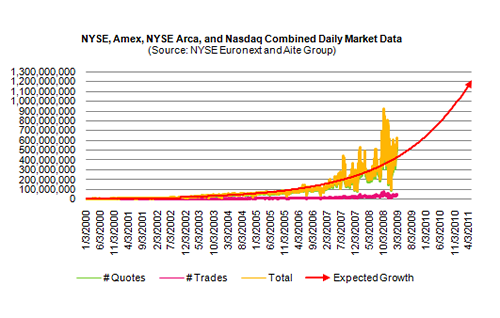

If U.S. equities continue their pace, Aite Group expects message volumes to average 1.2 billion messages per day by 2011.

Boston, MA, April 22, 2009 – A new report from Aite Group, LLC explores domestic and global market data volume trends, data capacity, emerging technology, and costs associated with specific market data functions for both equities and derivatives. Based on in-depth interviews with more than two dozen industry insiders, Aite Group expects market data volumes to continue to grow exponentially, further straining market data infrastructures.

Without exception, the number one challenge to market data infrastructures among firms Aite Group interviewed involved the exponential growth in data volumes. Across U.S. market data rates, data volumes nearly doubled on an annual basis over the last two years. Looking at U.S. equities alone, Aite Group expects message volumes to average 1.2 billion messages per day by 2011. Still, just over half of market data professionals believe their current market data infrastructures are good enough for today's challenges, let alone the challenges of tomorrow.

"Due to industry-pervasive budget cuts, many firms will be expected to do more with less when it comes to market data infrastructure," says Adam Honoré, senior analyst with Aite Group and author of the report. "Firms should consider what data is actually necessary to store, and what internally managed information truly provides a competitive edge. Further, vendors should be considered carefully and realistically before selection. The biggest players may not be right for every firm's needs."

This 40-page Impact Report contains 31 figures and one table. Clients of Aite Group's Institutional Securities & Investments service can download the report.