Investment Research Unbundling: Implications for the Sell-Side

Report Summary

Investment Research Unbundling: Implications for the Sell-Side

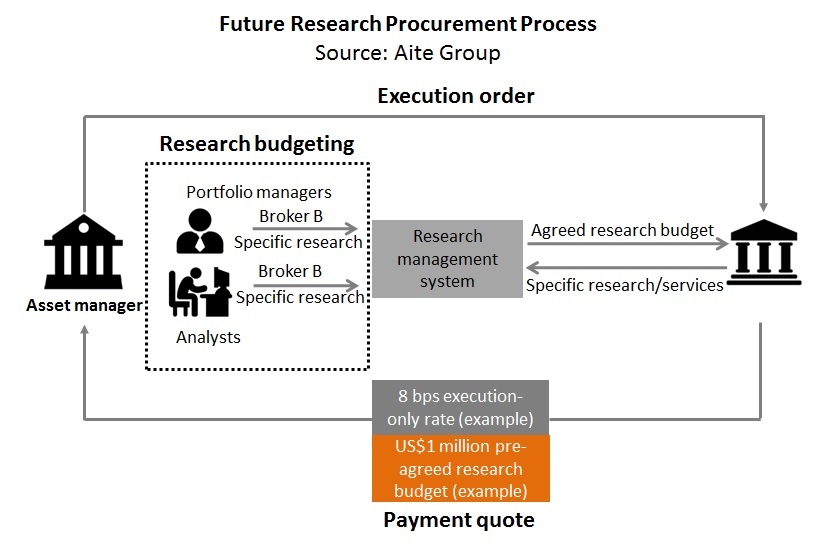

MiFID II’s unbundling provisions will prompt brokers to pivot their research businesses from cost centers to profit-generating divisions.

Boston, July 20, 2017 – Among the raft of legislative standards set out under the revised Markets in Financial Instruments Directive (MiFID II) is a call for a clear demarcation between the purchase of research and related services and of trade execution. Investment research has traditionally been seen as a cost center for brokers, often given away to generate trade commissions. So how will global brokers adjust their business models in preparation for unbundling?

Based on Q1 and Q2 2017 Aite Group interviews with global and regional investment managers, brokers, investment research providers, and vendors, this report looks at the latest call for unbundling in the European Union and its repercussions in the investment research industry and across sell-side firms. It is the second in a series of two—find the first here.

This 36-page Impact Report contains seven figures and six tables. Clients of Aite Group’s Institutional Securities & Investments service can download this report, the corresponding charts, and the Executive Impact Deck.

This report mentions 7Park Data, Accern, Airex Market, Alphametry, AlphaSense, AnalytixInsight, Bloomberg, Castine, Commcise, Connotate, CorporateAccessNetwork, Cowen Convergex, Dealogic, Eagle Alpha, ERIC: Electronic Research Interchange, Estimize, ExtractAlpha, FactSet, FeedStock, FinStats, HedgeChatter, IBES, ICE, LSE, IHS Markit, Instinet, ITG, KCG, Kuberre Systems, Liquidnet, Market Prophit, Meetyl, Morningstar, Premise Data, RavenPack Partners, Research Tree, ResearchPool, RS Metrics, RSRCHXchange, Seed Alpha, Smartkarma, SpaceNow, Substantive Research, Thinknum, Thomson Reuters, Visible Alpha ONEaccess, and WeConvene.