Insurer-Affiliated Advisors 2011: Key Attributes and Attitudes

Report Summary

Insurer-Affiliated Advisors 2011: Key Attributes and Attitudes

Given their large books of business, heavy workloads, and anticipated rise in AUM income fees, insurance-affiliated advisors favor the use of technology.

Boston, August 4, 2011 – A new report from Aite Group examines the specific class of financial advisors employed at broker-dealers housed within insurance firms. The report is based on a Q1 2011 Aite Group survey of 438 financial advisors, and specifically the responses of 32 advisors affiliated with brokerages that are part of a life insurance company. It delineates some of the key differentiators between insurer-affiliated advisors and their counterparts who are employed by other types of broker-dealers, and the implications of these traits to the business models of the advisors, insurers, and broker-dealers involved.

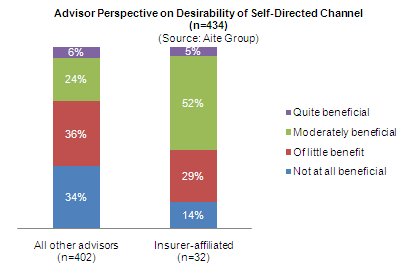

While life insurance is the principle product sold by insurance-affiliated advisors, most have a strong interest in selling other investment products as well. These advisors deal with fewer high-net-worth individuals than do their non-insurance-affiliated counterparts, and therefore have fewer assets under management. They do have large books of business, however, and expect AUM-based fee income to be the fastest-growing portion of their business over the next three years. Given their large books of business, commensurately heavy workloads, and anticipation of a rise in income derived from AUM fees, insurance-affiliated advisors look favorably on the use of technology, such as platforms that let investors manage their own investments to make their businesses more scalable and keep clients satisfied.

“In line with their relatively modest revenue production, insurer-affiliated advisors have relatively modest technology budgets, and may very well run core functions on Excel- or Access-based platforms,” says Clark Troy, research director with Aite Group and author of this report. “This has created a market for solutions providers that offer robust and scalable solutions at reasonable price points.”

This is the first report to come out of Aite Group’s advisor survey about the specific attributes of the insurer-affiliated advisor population. It will be followed in fall 2011 by another report focusing in greater detail on specific operational and technology questions elucidated by Aite Group’s survey data.

This 23-page Impact Report contains 16 figures. Clients of Aite Group's Life Insurance and Wealth Management services can download the report.