Global Fraud and Clueless Customers

Report Summary

Global Fraud and Clueless Customers

In A World Filled With Plentiful Fraud And Confused Consumers, Financial Institutions Must Educate, Educate, Educate.

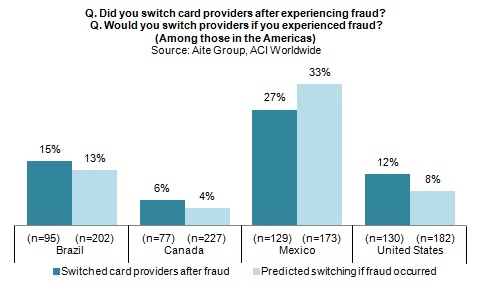

Boston, August 14, 2013 - Financial fraud--and consumer awareness of it--continues to grow across the globe. Despite this, consumer education regarding fraud appears to be severely lacking in many countries, leading to consumers who don't understand payment systems, fraud, or how to best protect themselves against becoming fraud victims. Further, consumers' perceptions about what causes fraud may be distorted, leading to confusion, dissatisfaction, back-of-wallet behavior, or even dreaded attrition. Understanding consumers' concerns, experiences, and resulting behaviors is therefore essential for financial institutions that desire to educate and retain clients and maximize payments revenue.

Based on Aite Group analysis of a Q3 2012 ACI Worldwide study of 5,223 consumers in 17 countries, this report by senior analyst Shirley Inscoe illuminates, for the Americas, EMEA, and the Asia-Pacific, consumers' thoughts, reactions, and behaviors related to financial fraud. It also gauges consumer perceptions of fraud for various banking activities and evaluates the risk of customer attrition following a fraud incident.

This report is the second in a two-part series that analyzes the survey results--find part one here.

This 51-page Impact Report contains 42 figures. Clients of Aite Group's Fraud & AML service can download the report.