Evaluating Futures Trading Platforms: Competing in a Changing Landscape

Report Summary

Evaluating Futures Trading Platforms: Competing in a Changing Landscape

Boston, MA, October 23, 2008 – A new report from Aite Group, LLC reviews the current offerings of the major players in the futures execution space, from traditional point-and-click software vendors, to algorithmic systems, to market data providers that offer execution systems. The report also examines trends in futures execution, specifically, the growth in trading via direct market access and FIX protocol.

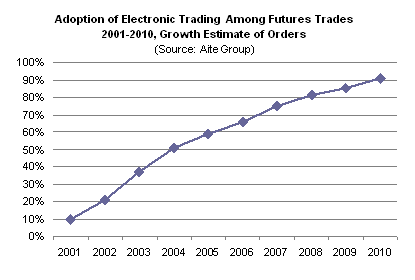

With the increased electronification of the markets in recent years, the futures market too has moved toward direct market access. While this has allowed traders to execute orders more quickly, and without the errors often associated with human intervention, futures trading platforms have scrambled to remain competitive. Increasingly, traders see multi-asset class platforms, which use the FIX protocol, as a viable alternative to futures trading platforms. To combat this, many futures trading platforms are offering additional connections to other asset class venues in an effort to prevent traders from migrating to traditional multi-asset class platforms. As the industry continues to evolve, so too must futures trading platform vendors that wish to remain relevant.

"The trend toward trading directly to the exchanges without human intervention will continue to dominate the futures execution space," says Paul Zubulake, senior analyst with Aite Group and author of this report. "The vendors who have supported futures trading will have to continue to adjust their business to support an order-routing model with global connectivity, as well as to provide flexible software for developers to counter the influx of multi-asset front-ends that now offer futures trading capabilities."

This 49-page Impact Report contains 20 figures and 14 tables. The report profiles futures trading platforms Bloomberg TradeBook, CQG, FFastFill, GL Trade, ORC Software, Patsystems, RealTime Systems (RTS), Thomson Reuters and Trading Technologies.

Clients of Aite Group's Institutional Securities & Investments service can download the report.