Cross-Border Consumer Money Transfers: An Update

Report Summary

Cross-Border Consumer Money Transfers: An Update

Consumer money transfers are on the rebound, but the days of double-digit growth are over.

Boston, July 14, 2011 – A new report from Aite Group sizes and forecasts volume by region for the cross-border consumer money transfer market, including workers' remittances and related person-to-person money transfers. The report, an update to Aite Group’s June 2010 report, Money Transfers: The Tipping Point, is based on Aite Group analysis of data reported by central banks, the International Monetary Fund (IMF), and the Inter-American Development Bank (IADB), as well as country-level data and insights from money transfer organizations (MTOs).

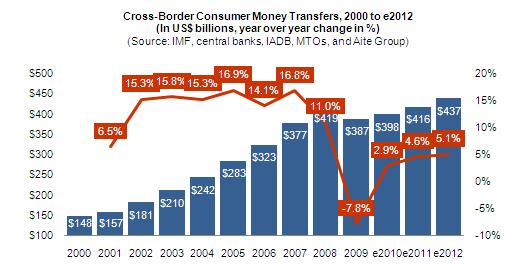

After declining 7.8% in 2009, Aite Group estimates that cross-border consumer money transfers grew 2.9% in 2010. We expect the market to continue to grow 4.6% in 2011 and 5.1% in 2012, reaching US$437 billion by 2012.

“While growth has resumed after the dip in 2009, the days of double-digit—or even high single-digit—growth are over,” says Gwenn Bézard, research director with Aite Group and author of this report. “Money transfer firms can no longer count on a rising tide to lift their boats.”

This 15-page Impact Note contains nine figures. Clients of Aite Group's Retail Banking service can download the report.