Chinese Onshore Markets: Scaling the Great Wall

Report Summary

Chinese Onshore Markets: Scaling the Great Wall

China is making capital markets progress, but it still has a long way to go.

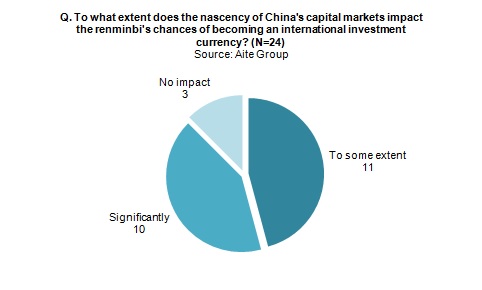

London, 6 August 2014 – The insulation of China’s financial sector once stunted the growth of its financial markets, but now China is beginning to develop and expand its domestic markets. Enhancing the attractiveness of the onshore market will be vital to the process of capital account liberalization; meanwhile, regulatory restrictions, administrative challenges, and a lack of clarity regarding future plans continue to hamper the growth of China's onshore markets in the short term. Nevertheless, Chinese capital markets are gradually internationalizing, increasingly offering access to the markets beyond its wall and bringing market structure standards into closer alignment with the rest of the world.

This Impact Report, the first in a series of two and based on early 2014 interviews with market participants from 24 firms, examines the development of the Chinese capital markets and their gradual liberalization at the hands of the domestic government and regulators. It also looks at data on the foreign exchange, fixed income, derivatives, and equities markets, as well as provides an overview of the infrastructure and regulatory structures in these markets.

This 41-page Impact Report contains 24 figures and two tables. Clients of Aite Group's Institutional Securities & Investments, Wealth Management, or Wholesale Banking & Payments services can download this report.