Branch and Teller Capture: A Vendor Overview

Report Summary

Branch and Teller Capture: A Vendor Overview

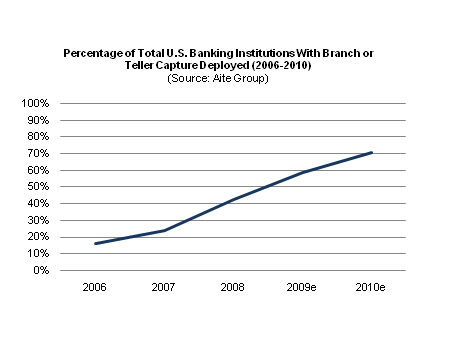

Despite cost savings, streamlined processes and fraud reduction capabilities, only 42% of U.S. banks currently use branch or teller capture solutions.

Boston, MA, December 17, 2008 – A new report from Aite Group, LLC provides an overview of the U.S. branch and teller image capture market. The report offers a competitive overview of branch and teller capture vendor software solutions, and profiles the vendors offering such solutions.

Banks choose to deploy branch and teller capture for a variety of reasons, including reducing over-the-counter costs, creating more opportunities for branch staff to sell to customers, reducing manual processes, eliminating paper processing, creating greater internal efficiencies and addressing fraud. Despite the advantages provided to banks and credit unions by branch and teller capture, only 42% of them were using such solutions in 2008, leaving tremendous room for growth. Fortunately, vendors are offering solutions that allow banks more image capture deployment options: Banks can capture images at the teller line, the branch back-office, or at a central branch location. They can also choose to process transactions at the branch or central bank location or outsource processing to a vendor, and can implement the technology as a software application or a software-as-a-service (SaaS) solution.

"The number of banks using branch and teller capture today still makes up a small portion of the entire banking market in the United States," says Kate Monahan, analyst with Aite Group and author of this report. "In the next few years, as banks realize the value provided by image capture, more will implement solutions. Banks should weigh whether branch or teller capture best suits their needs. If unsure, they should discuss with their potential vendors who can help build a solid business case."

The report examines 14 leading branch and teller capture software solutions used by North American banking institutions, and includes profiles of the following 12 vendors: Diebold Incorporated, Fidelity National Information Services, Fiserv, Goldleaf Financial Solutions, Harland Financial Solutions, Jack Henry & Associates, NCR Corporation, Metavante Corporation, Myriad Systems Inc. (MSI), S1 Corporation (FSB Solutions), VSoft Corporation, and WAUSAU Financial Systems. Vendor products are evaluated on customer advocacy, level of integration with additional branch technology solutions, level of image capture integration, sales performance, deployment experience, and features and functionalities.

This 65-page Impact Report contains 24 figures and 11 tables. Clients of Aite Group's Retail Banking service can download the report.