Asset Management Year in Review, 2022: Industry Repositions in the “New Normal”

Report Summary

Asset Management Year in Review, 2022: Industry Repositions in the “New Normal”

The asset management industry has gone through turbulent times before, but 2022 represented a significant downturn.

April 12, 2023 – 2022 represented a challenging year for managers faced with uncertain macroeconomic conditions, falling markets, and overall investor uncertainty. The biggest impact on bottom lines has been the fall in the equity market in 2022, crashing down total assets under management. To counteract the losses, mergers and acquisitions were a popular route to gain scale or expertise as a way to combat the dominance of passive investments.

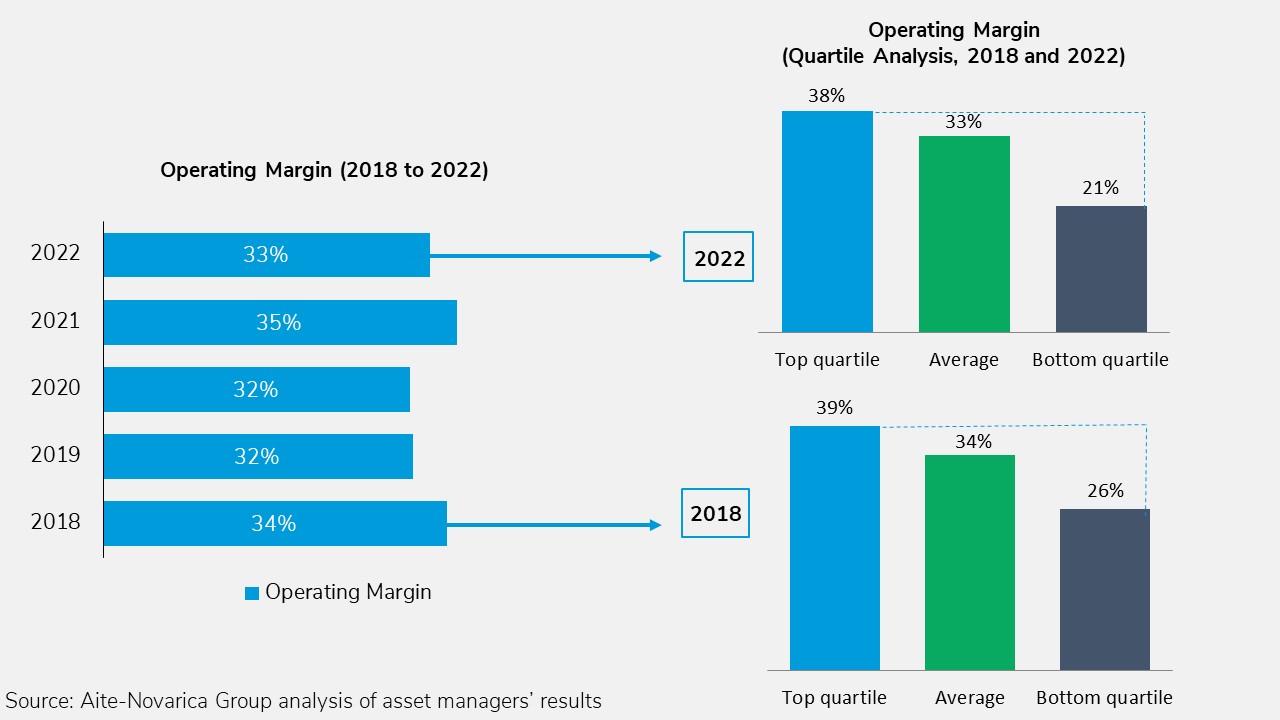

This report is Aite-Novarica Group’s inaugural annual review of the business performance and profitability of the asset management industry. It is based on is based on analysis of 40 publicly listed buy-side institutions.

Clients of Aite-Novarica Group’s Capital Markets service can download this report.

This report mentions ABN Amro, Abdrn, Alcentra Group Holdings, AllianceBernstein, Allianz Global Investors, Apex Group, Arcmont Asset Management, AssetCo, ATLAS Responsible Investors, Aviva Investors, BlackRock, Bloomberg, BNP Paribas, BNY Mellon, Bread Street Capital Partners, Brewin Dolphin, Broadridge, Comgest, Callodine Group, CarVal Investors, Citibank, Czech Asset Management, Franklin Resources, Futuregrowth Asset Management, Goldman Sachs, Interactive Investor, M&G, NN Investment Partners, Nuveen, Pznena Invest Management, Rathbone Funds, River and Mercantile, Royal Bank of Canada, Sanlam, Sarasin, SimCorp, Singlife, State Street, UBS Group AG, Voya Financial, and Wealthfront.