The Allure of Greener Grass: An Analysis of Merchant Attrition

Report Summary

The Allure of Greener Grass: An Analysis of Merchant Attrition

Aite Group urges merchant acquirers to segment their sales force by vertical to curb attrition.

Boston, MA, January 22, 2009 – A new report from Aite Group, LLC looks at customer attrition among merchant acquirers. Based on an Aite Group survey of 160 merchants, conducted from May through August 2008, the report quantifies merchant attrition rates and provides insight into why merchants leave their processors.

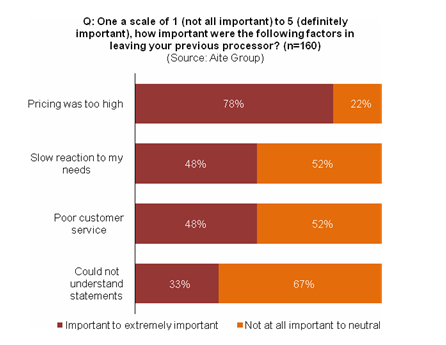

Attrition in merchant acquiring is dynamic. Independent Sales Organizations (ISOs) and acquirers expend considerable resources seeking merchants, marketing to them, signing them up, and then onboarding and servicing them, only to see a good number of them leave, sometimes without giving a reason. ISOs and acquirers find it easier to double their acquisition efforts to compensate for lost merchants instead of tackling attrition problems. Attrition in merchant acquiring represents a great opportunity for ISOs and acquirers to pick up new customers, though competitors seeking to attract merchants away from incumbent providers must come up with a good value proposition. More than half of merchants that accept card payments have changed processors at least once since they started their business. Among the reasons most cited are pricing, slow reaction to needs, and poor customer service.

"While pricing is definitely an important reason for merchant attrition, it is often not the only reason that a merchant leaves its processor," says Adil Moussa, analyst with Aite Group and author of this report. "Dissatisfaction with a certain aspect of the merchant processing relationship is generally what pushes merchants to consider leaving. ISOs and acquirers must focus on enhancing their product offerings, developing stellar customer service and ensuring they are accessible to their merchants. By structuring the customer service by vertical, processors may better appeal to their merchant customers."

This 32-page Impact Report contains 23 figures. Clients of Aite Group's Retail Banking service can download the report.