Aite Matrix: Buy-Side OMS Market 2022

Report Summary

Aite Matrix: Buy-Side OMS Market 2022

April 28, 2022 – In the order management system space, change comes in waves, and the asset management industry is unlikely to look the same in 10 years. Cost pressures and advances in technology have pushed firms to innovate in areas such as automation, artificial intelligence, and cloud deployment, as new features and workflows help manage business growth or a reduction in human resources.

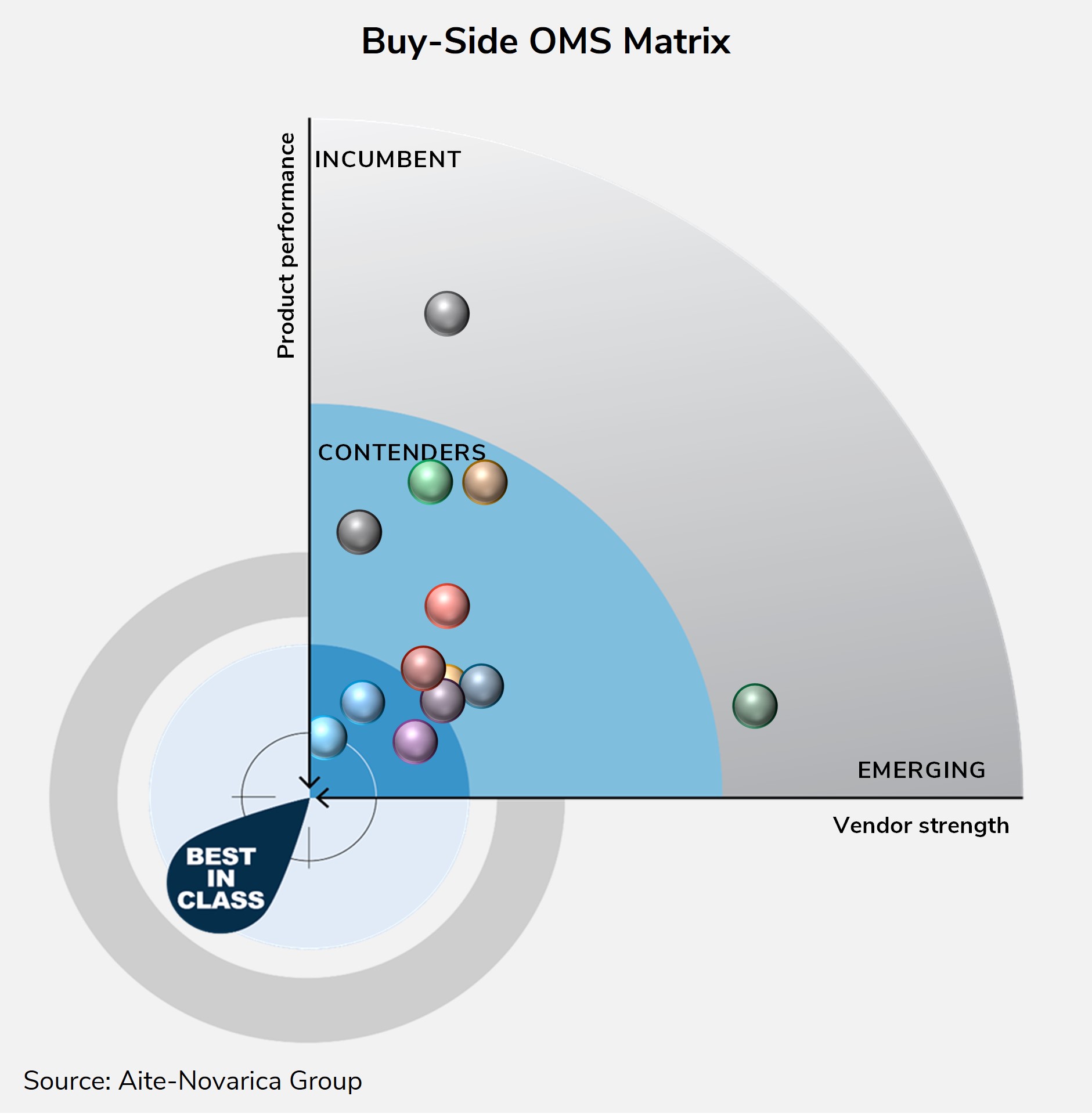

This report explores some of the key trends within the global buy-side OMS market and discusses the ways technology is evolving to address new market needs and challenges. Leveraging the Aite Matrix, a proprietary Aite-Novarica Group vendor assessment framework, this Impact Report evaluates the overall competitive position of 13 vendors, focusing on vendor stability, client strength, product features, and client services. These 13 vendors are Bloomberg, Broadridge, Charles River Development, Enfusion, FIS, Indata, Limina, Linedata, Refinitiv, S&P Global Market Intelligence, SimCorp, SS&C Advent Moxy, and SS&C Eze. This report also profiles BlackRock, Rebar Systems, Ridgeline, and TORA Trading.

This 96-page Impact Report contains 20 figures and 13 tables. Clients of Aite-Novarica Group’s Capital Markets service can download this report and the corresponding charts.