2017 Council Meeting Report

Report Summary

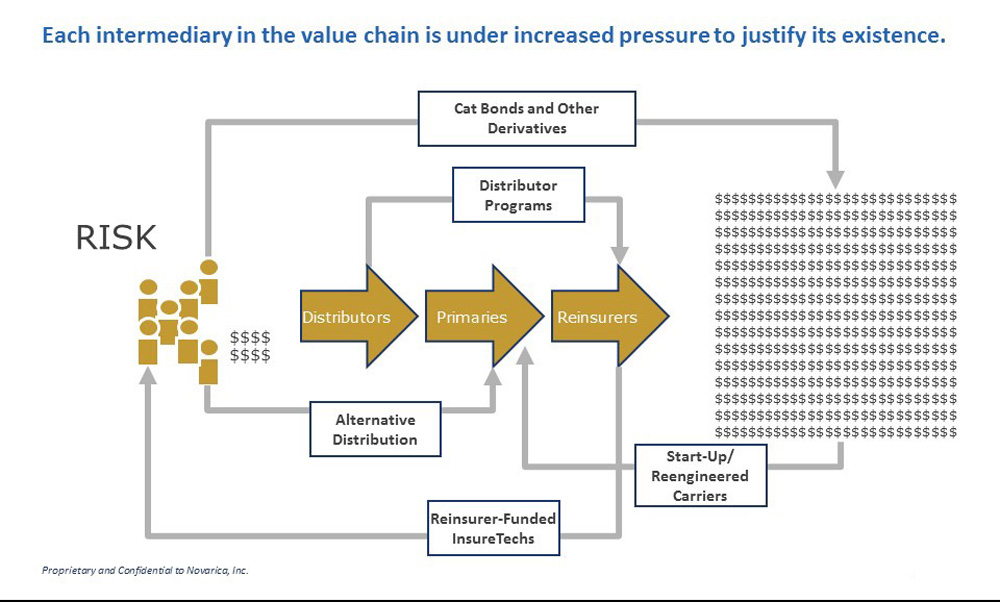

May 2017 - Artificial intelligence, disaggregation of value, and the ability of IT to create business value were some of the main topics of discussion among insurer CIOs and their teams at the 10th Annual Novarica Insurance Technology Research Council meeting. As technology drives fragmentation of value in both the insurance value chain and in the insurance product itself, insurer CIOs are striving to balance the challenges of yesterday with the needs of today and the opportunities of tomorrow.

Facing innovation pressures from without and within; growing demands for improved data, digital, and core capabilities; and the ongoing needs of cybersecurity, insurer CIOs are driving value for their companies and positioning them for the future.

Topics Covered

- Innovation and Transformation including lessons from InsureTech, formal innovation programs, and core systems transformation.

- Project-specific Challenges including how regulatory and market changes are driving strategy.

- Compliance Pressures on Security and BCP/DR as state regulators get more aggressive.

Key Points and Findings

Artificial intelligence is coming. 10-20% of insurers are already using machine learning to improve rating algorithms.

Driving innovation, leveraging InsureTechs, and meeting the needs of Millennials are creating additional pressure on inflexible legacy environments and organizational practices.

Security is moving to the front burner, driven in part by NYS regulations that require a designated Chief Information Security Officer.