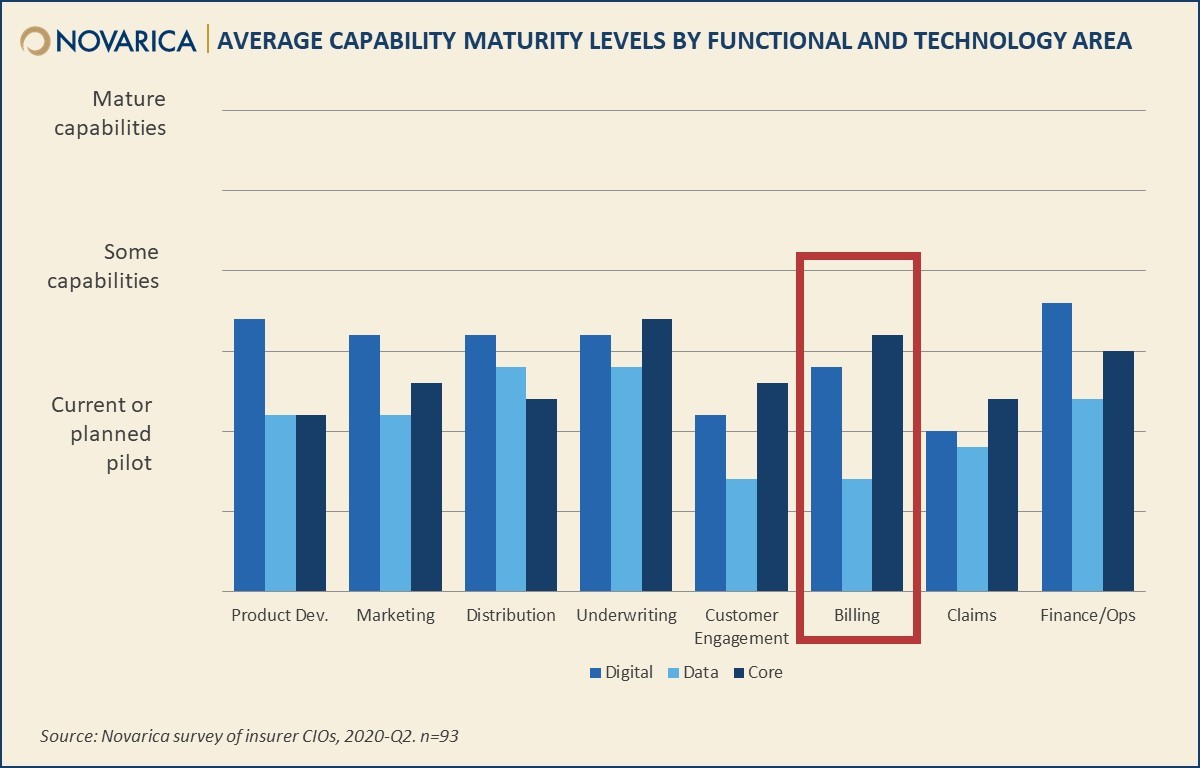

Insurer billing capabilities are relatively mature in digital and core. Consumer expectations for digital experiences and payments have been shaped by online banking and e-commerce; insurers have adapted by offering flexible online billing and payment options. Insurers’ data and analytics capabilities for billing data, however, are the least mature of any functional area on average. Insurers have room to develop these capabilities.

The Novarica 100 Framework includes 12 capabilities in eight functional areas: product development, marketing, distribution, underwriting, customer engagement, billing, claims, and finance/operations. These capabilities are divided into four digital, four data, and four core functions. There are also four capabilities specific to the operations of IT, which round out to an even 100.

Digital capabilities in billing include e-bill, omni-channel notifications, and the ability to accept payments via credit card or SMS text.

Data and analytics billing capabilities include analytics to flag potentially delinquent payments and premium leakage analytics as well as AI and machine learning capabilities to improve these functions.

Billing core capabilities cover consolidated summaries for policyholders with multiple products, customizable billing schedules, automated recalculation due to policy changes, and externalizable APIs for partner systems.

Billing digital capabilities reflect an increasingly online consumer base, especially among property/casualty insurers, whose products are more commoditized. E-bill and credit card payments are essentially table stakes, and more than half of P/C insurers have deployed omni-channel notifications.

Core capabilities likewise reflect high maturity levels; around three-quarters of insurers have deployed consolidated bill, customizable payment schedules, and automatic recalculation. Externalizable APIs are less common, though APIs have been maturing in underwriting and distribution, so they’ll likely follow for billing.

Billing data capabilities are much less mature, as few insurers are pursuing data-driven messaging or AI/machine learning in this area. However, P/C insurer use of analytics to engage policyholders proactively and avoid cancellation/reinstatement cycles has grown since 2019.

Life insurers tend to lag their P/C counterparts since billing cycles are less frequent and there’s less pressure to deliver a digital experience that competes with banking or other apps in this sector. Digital capabilities for e-bill and credit card payments are common (but not ubiquitous) among life insurers, as are core capabilities for bill consolidation and customization. More than a quarter of L/A insurers have yet to deploy billing data capabilities.

The N100 framework is also available as a self-rating tool for insurers; if you’re a Novarica client or Research Council member interested in benchmarking your company, feel free to contact [email protected] to receive a copy.

Add new comment