As the year 2020 proceeds to its conclusion, the status quo has been washed away. But some things have not changed. The goal of every claims organization has been and will remain quickly adjusting a claim at a low cost with high levels of customer satisfaction.

These goals are often at odds with each other, which highlights the importance of strategic alignment. Insurance carriers have looked to deploy a balanced scorecard for their claims organization to measure results. This scorecard often contains:

- Claim count information including new claims, pending claims, backlog claims, closed claims, and closed claims by severity

- Average open day inventory

- Average cases per adjuster

- Average time to close by severity

- Claim duration segmented by ground-up loss value (aka severity against open duration)—higher value claims tend to take longer and are more likely to be litigated

- Leakage

- Voice of the customer/customer satisfaction/NPS

- Number of transactions on existing open claims (evaluated across the different roles within the claims department)

- FTE to open claim count (daily, weekly, monthly, prior year comparisons)

- LAE for outside vendors

Artificial intelligence (AI) has been deployed in claims organizations in a way that has significantly impacted the balanced scorecard and many of the factors listed above.

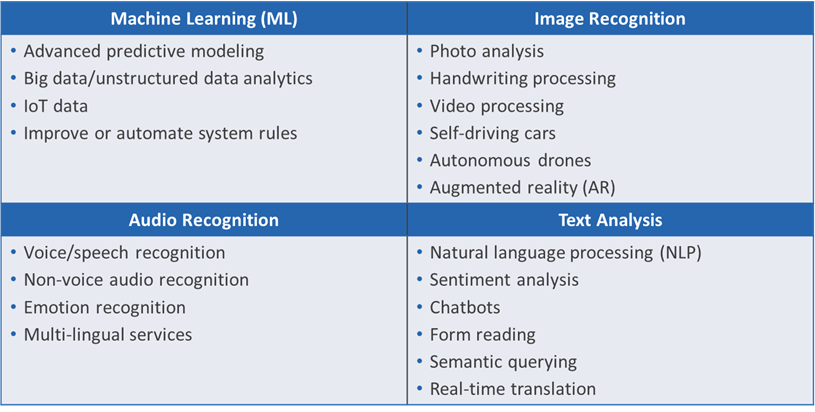

There are four major categories of AI and subsets of technology within each category:

Let’s explore how these technologies have been exploited by insurance carriers.

Machine Learning

IoT data is now being collected for a number of types of insurance policies and can be used to help adjudicate a claim, report a first notice of loss, avoid a claims loss, or estimate the severity of the loss. Examples are everywhere, including equipment reporting data that could indicate an imminent breakdown, trucks providing data on engine wear and tear, and personal autos providing UBI and telematics information to help understand how the accident occurred and the extent of the loss (is it a total loss?).

Unstructured data analysis can be used to predict claims losses from weather events like fires or hurricanes—or even to report losses like the crop damage in Iowa caused by the August 2020 derecho (shades of green from drones and satellite pictures from crop fields). Salvage and potential fraud can also be detected with predictive modeling. Adjuster performance can be measured to suggest improvements in the adjudication rules or identify individual performance improvements. Legal billings can be reviewed by predictive models to offer suggestions around changing venue or outside firm.

Image Recognition

Photos combined with machine vision technologies are being used to determine the extent of damage to an automobile from pictures taken by the driver’s mobile phone. Augmented reality is being used by adjusters to walk on a roof virtually and determine the damage from a storm using a 3-D rendering from a picture combined with AR goggles. Image analysis can help determine subrogation in auto accidents where the intersection is photographed.

Audio Recognition

Emotion recognition is being used to determine how people are feeling when talking with call centers and adjusters. Multi-lingual services are supporting non-English speakers when discussing claims.

Text Analysis

Chatbots are being used to collect information about the claim when first reported and providing information about the claim throughout the adjudication process. Natural language processing is being used by insurance carriers to mine claims adjuster notes and identify additional areas when the adjudication process can be improved or made more efficient. Form reading is speeding up processing of the claims, especially for documents like police reports. Claims straight-through processing is often facilitated via text analysis and can help dramatically lower the cost of ingesting a claim.

Upcoming Special Interest Group

On November 5, my colleague Deb Zawisza and I will host our Virtual Special Interest Group to cover the latest challenges around P/C claims and how new technology like AI can help reduce costs and improve customer service. Please register and join us and your peers in the conversation.

Add new comment