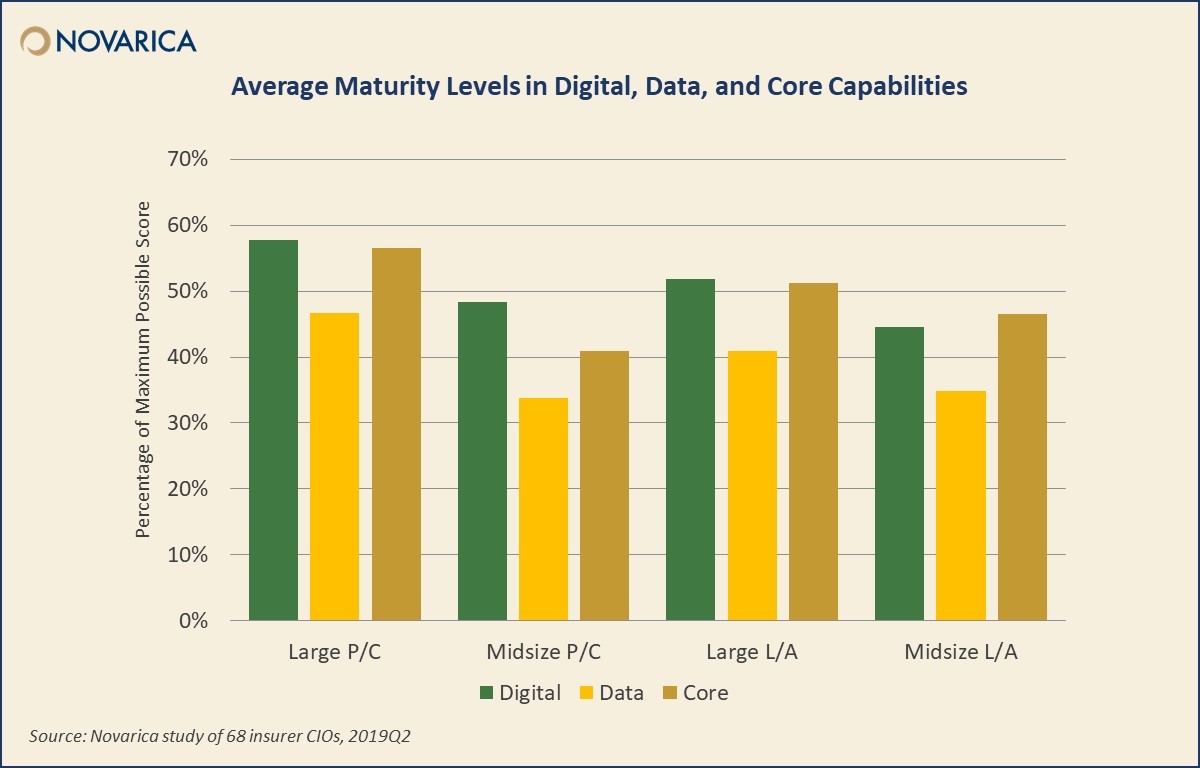

We recently published the Novarica New Normal 100 digital, data, and core capabilities reports to help insurers benchmark their technology-enabled capabilities against the industry. The reports are based on a study of 50 P/C and 18 L/A CIOs and look at maturity and deployment rates of each capability.

Property/casualty insurers have generally broadened and matured technology capabilities in the past year. The capabilities gap between large and midsize insurer is shrinking, though it remains stark in areas like digital and analytics applied to claims. Analytics and mobile have seen the most notable growth among both groups of carriers, though RPA and API capabilities have also expanded. These technologies can work in tandem; as an example from our recent Insurance Technology Case Study Compendium, Everest combined internal analytics with API calls to external data sources to model wildfire risk.

Large P/C insurers are piloting new analytics and AI capabilities. AXA XL is one such carrier, having implemented NLP to automate review of risk engineering surveys. By contrast, midsize insurers are closing the gap by investing in areas that are table stakes for large insurers like mobile FNOL and 360-degree customer view. For example, COUNTRY Financial built a customer mobile app that supports self-service in areas like bill payment, policy view, and requests for roadside assistance.

Life/annuity insurers are also expanding digital capabilities to include a broader range of functions including billing and claims. Analytics is an additional growth area, especially pre-fill data and predictive analytics for distribution and underwriting. Principal Financial used analytics to build a predictive model that determines the likelihood of winning pension risk transfer RFPs, as an example.

Like their P/C counterparts, larger L/A insurers generally maintain an advantage in digital and analytics capabilities. Gerber Life, for example, built a digital sales and underwriting system that supports direct-to-consumer, resulting in 72% reduction in underwriting time. However, smaller insurers are catching up and report high levels of planned pilot activity.

For more on the ever-changing insurance landscape, check out the Novarica New Normal 100: Digital, Data, and Core Capabilities for Property/Casualty Insurers and the Novarica New Normal 100: Digital, Data, and Core Capabilities for Life/Annuity Insurers. For more case studies, see our Insurance Technology Case Study Compendium 2019.

Add new comment