We recently published the Novarica New Normal 100, for P/C and L/A, which covers 100 digital, data, and core capabilities for insurers across eight functional areas: product development, marketing, distribution, underwriting, customer engagement, billing, claims, and finance/operations.

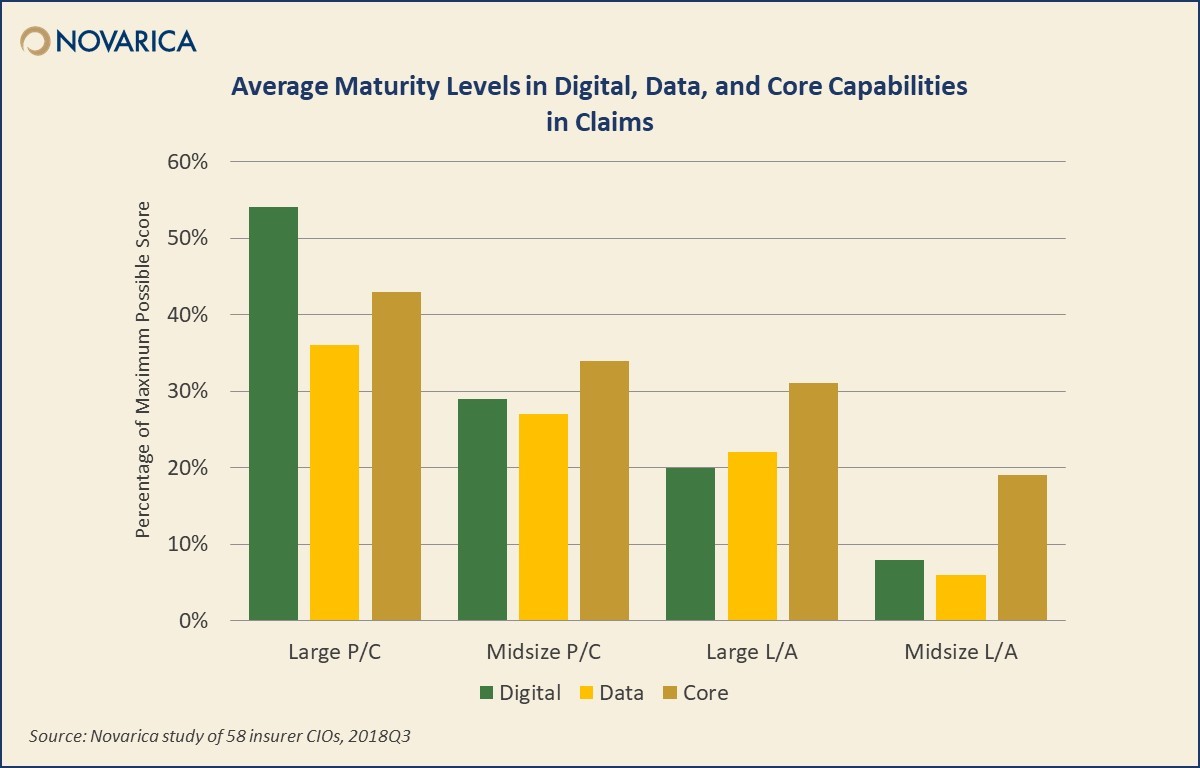

The framework we designed applies to both life/annuity and property/casualty insurers. Our recent reports include analysis of data from Novarica’s study of 41 P/C and 17 L/A CIOs, which looks at current and planned deployment rates of each capability. Participants were asked to rate their current capabilities level in each of the 100 areas either mature (3), some (2), current or planned pilot (1), or no current or planned activities (0).

The relevance of claims capabilities varies widely within the life/annuities segment. However, for insurers that write disability, dental, or other health-related voluntary benefits or complex individual products, most of the claims capabilities in the framework are relevant.

More than half of large L/A insurers are using predictive analytics for claims in some capacity, and most of those that don’t currently have fully digital claims processes or skills-based routing for claims do have current or planned pilots.

In the P/C group, large insurers are significantly more advanced in digital claims. 71% of large insurers support mobile first notice of loss, compared to less than 25% of midsize insurers. Large property/casualty insurers are also twice or three times as likely to be using predictive analytics in claims, and four times as likely to have capabilities in straight-through processing for claims.

For more on the ever-changing insurance landscape, check out the Novarica New Normal 100: Digital, Data, and Core Capabilities for Property/Casualty Insurers and the Novarica New Normal 100: Digital, Data, and Core Capabilities for Life/Annuity Insurers.

Add new comment