We recently published the Novarica New Normal 100, for P/C and L/A, which covers 100 digital, data, and core capabilities for insurers across eight functional areas: product development, marketing, distribution, underwriting, customer engagement, billing, claims, and finance/operations.

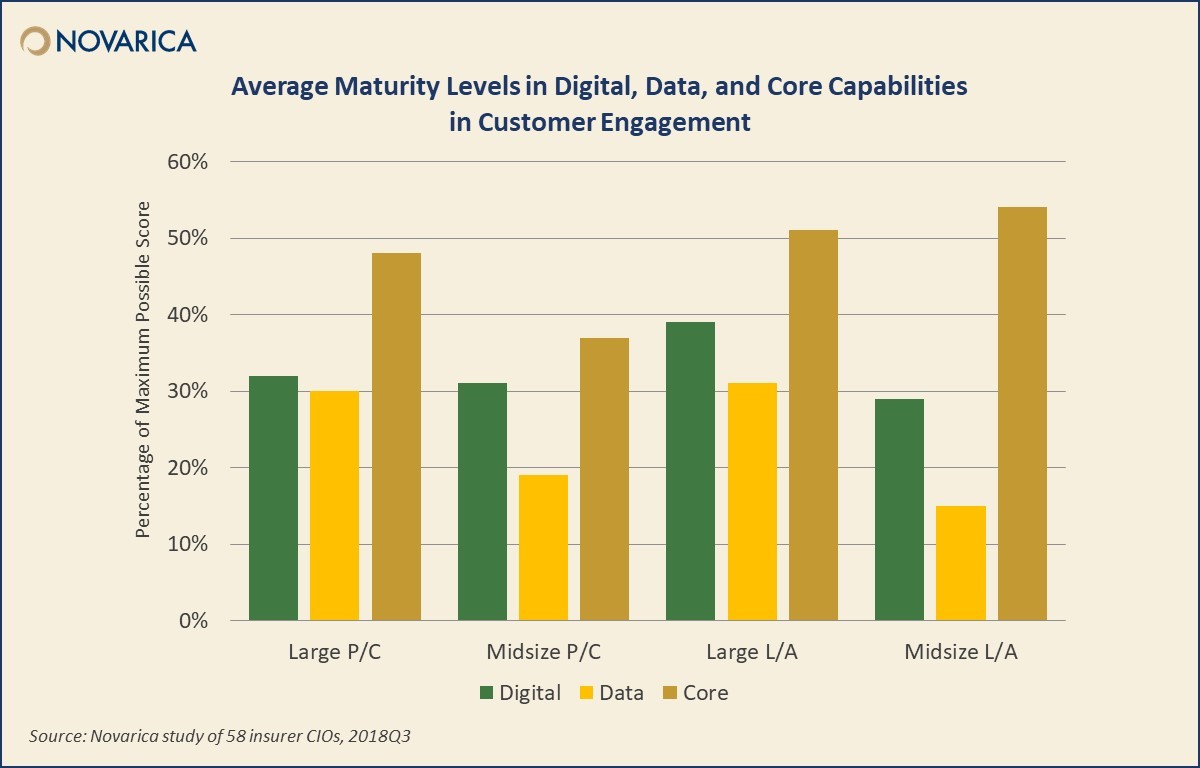

The framework we designed applies to both life/annuity and property/casualty insurers. Our recent reports include analysis of data from Novarica’s study of 41 P/C and 17 L/A CIOs, which looks at current and planned deployment rates of each capability. Participants were asked to rate their current capabilities level in each of the 100 areas either mature (3), some (2), current or planned pilot (1), or no current or planned activities (0).

Customer engagement has been an area of underinvestment by most insurers, who are used to relying on their distribution channel intermediaries for customer support.

Large L/A insurers have slightly less advanced digital customer engagement capabilities in established areas and more capabilities than midsize insurers in emerging areas, as well as higher pilot activity across the board. In data, maturity levels are low across the board, but pilot activity is high for large L/A insurers. Midsize L/A insurers have higher average maturity levels in core capabilities, possibly due to their smaller and less complex customer bases.

In digital customer engagement within the P/C segment, more midsize insurers than large insurers are confident in their mature Web and email customer support, while in the use of data and analytics, larger P/C insurers continue to have significantly more capabilities across the board.

For more on the ever-changing insurance landscape, check out the Novarica New Normal 100: Digital, Data, and Core Capabilities for Property/Casualty Insurers and the Novarica New Normal 100: Digital, Data, and Core Capabilities for Life/Annuity Insurers.

Add new comment